According to the analysts, $6,592 level is crucial for an upside move. They see here a dense congestion including the Simple Moving Average 50-one-day, the SMA 10-1h, the SMA 10-4h, the SMA 5-1d, the SMA 50-15m, the SMA 100-1h, the Bollinger Band one-hour Middle, the SMA 5-4h, the Fibonacci 38.2% one-day, and the 1h- high.

Bitcoin is steady in range for a long time period.

What will be the next move? Here are the levels to see.

The next line to watch is probably $6,704 where they see the convergence of the Bollinger Band 4h-Upper, and the Pivot Point one-day Resistance 2.

Just a bit above, at $6,612, analysts see the Fibonacci 38.2% one-month, Fibonacci 23.6% one-day, the SMA 10-one-day, and the Bollinger Band 15m-Upper.

Please enter Coingecko Free Api Key to get this plugin works.

As a result, the road with the least resistance is now downward and the bulls need to break $ 6,592 to convince the market to push higher prices.

Also Bitcoin traded at a level below $ 1,500 during September, the lowest monthly trading range since September.

Bitcoin (BTC) officially ended the 30-day period with an investment of $ 1,329, and prices are at $ 7,429, a drop of $ 6,100. Overall, this was the lowest monthly period since July 2017, when bitcoin was traded in a $ 1.095.8 around, according to data from Bitcoinex.

In addition, the monthly trading volume since September marked the lowest level since April 2017, one of the world’s largest stock exchanges.

All in all, the path of least resistance is currently to the downside and bulls need to break $6,592 in order to convince markets to push the price higher.

Low volatility periods, especially with low volume, especially when it comes to an end-end for bitcoin, so the crypto currency appears to be moving upwards for a decisive move in both directions.

Monthly Chart

As the Bitcoin market has been on a downward trend since December 2017, the current price drop below the lowest level in September ($ 6,100) will probably confirm that a further downward movement will be approved and that the previous support / resistance level will approach $ 4,900.

On the other hand, if the range of September is high ($ 7,429), it will be an upward indicator for the long-term upside potential and potential bull market revival.

Knowing where these congestion points are located is very useful for the trader and can be used as a basis for different strategies.

20-Month Moving Average

The current bearish market is parallel to the bitcoin bear market in 2014-15.

In particular, the current bear market is only beginning to the 11th month, while prices are now sitting in support of the 20-month moving average (MA). Timing is quite flawless compared to the 2014 market since the 11-month-old, also based on 20-month MA.

The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Bitcoin bulls are looking at new technical signals in hopes that the cryptocurrency reverses its recent slump and starts pushing higher. Since then the bulls have not been able to recover their losses. For the bulls to be in equilibrium with the bears they have to break the levels $6, 500, $6,700 and $7,400 price levels.

This would suggest that a decisive movement may emerge as the tendency to fall below the MA in the 2014 month market further strengthens the downward trend in the downward trend in November 2015, when it is not able to escape until the MA returns.

Prediction:

⦁ Falling below the 20-month MA would likely confirm several more months of the bear market are ahead.

⦁ Falling below September’s low of $6,100 opens the door to prior support/resistance level near $4,900, while rising above Septembers high could signal a bull market revival.

⦁ This will be a decisive month for bitcoin as the low volatility suggests a big move is coming in either direction.

Summary

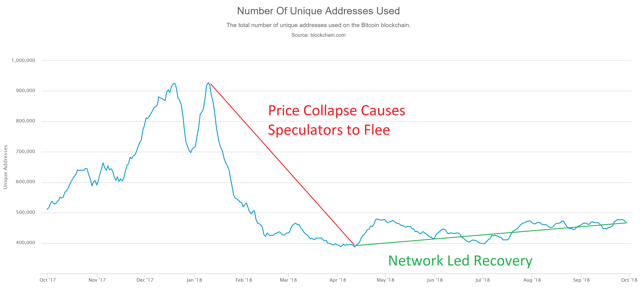

The more people use Bitcoin, the more value it is. Basically the value is in the network, like Facebook (FB) or Twitter (TWTR). Let’s make a quick summary of where we came from and where we are now.

This low point at unique addresses is a point where Bitcoin is around $ 6,900 around April 11, 2018.

Using the seven-day average of unique address counts (softens the low points caused by low volume at weekends), you may find that Growth has come to the mainstay since April. Today the price is lower, but the number of users seems to be increasing again, and this time the network can support more transactions than before because of Segwit Adoption.

To guess, we can say that Bitcoin can now process 50% to 100% more per second than the last peak in December / January

This article is so poorly written it’s hard to give credence to it. It seems like a 3rd grader is writing. I am gone and will never read another piece from this forum.