Advanced technology, backward banks and soaring wealth make China a leader in fintech

Even at a European conference about fintech, one country dominated the conversation: China.

This week, hundreds of fintech companies, from startups to tech giants, gathered at the Money 20/20 conference in Amsterdam, Netherlands. One key theme at the gathering was China’s leading role in the fintech industry.

“Alibaba and Ant Financial, we are literally the world’s largest fintech company, and we are the world’s largest e-commerce company, and these two massive machines still, on an annual basis, grow at more than 50 percent a year,” Li Wang, Alipay’s head of EMEA, told CNBC’s Arjun Kharpal at the conference.

Li said Alipay, a mobile and online payment platform, has 870 million active users, with 600 million in China and 270 million in the rest of the world. These user numbers are a testament to how quickly Chinese consumers have leapfrogged ahead of other countries when it comes to using fintech.

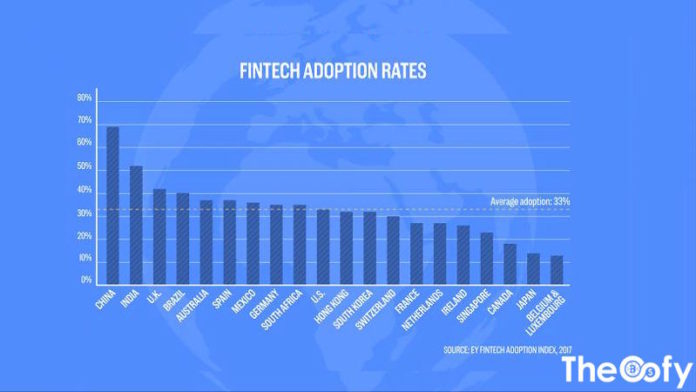

A study from accounting firm EY examined fintech adoption rates across 20 major economies. It found 69 percent of Chinese consumers had used at least two fintech services in the last six months. India came in second with 52 percent of consumers using fintech, followed by the United Kingdom at 42 percent.

“China comes out on top, where it’s fair to say there’s a large digitally-savvy, but financially underserved population,” said Thomas Bull, leader of the EY FinTech Adoption Index.

Mobile payments and transfers are the most frequently-used fintech service in China, with 83 percent of Chinese consumers making payments or money transfers on their phones. Fifty-eight percent of Chinese consumers reported using fintech platforms for savings and investments while 46 percent used fintech to borrow money. Source: CNBC | Giorgio Tonella