Bloomberg released a research report about the valuation of cryptoassets. This is the fourth part of a five-part series (on the cryptoasset market) that has been prepared by premier ICO advisory firm Satis Group.

Research firm Satis Group has released a new report making bold price predictions about the current leading cryptocurrencies on the market. It is attempting to create accurate valuations based on real-world data.

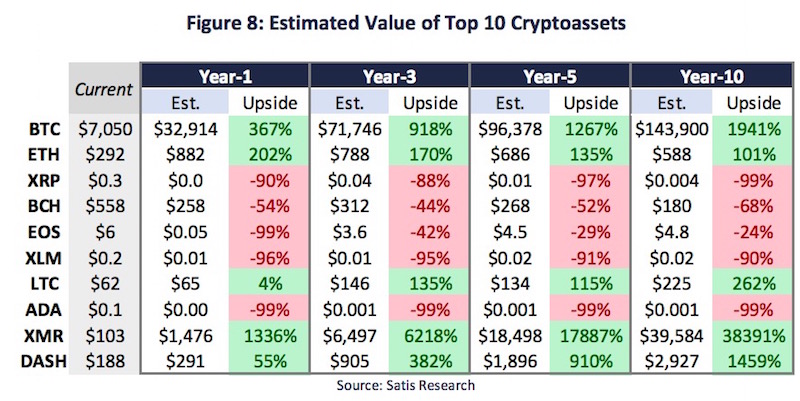

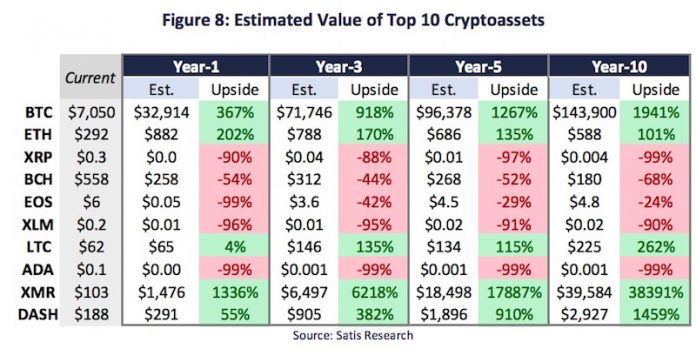

(BTC $143k, ETH $588, XRP $0.004, BCH $180, EOS $4.8, XLM $0.02, LTC $225, ADA $0.001, XMR $39,584 DASH $2,927)

Research Firm Satis Group Predicts Bitcoin at $144,000 in 10 Years, Bitcoin Cash at $180

Research firm Satis Group has released a new report making bold price predictions about the current leading cryptocurrencies on the market. It is attempting to create accurate valuations based on real-world data.

Individual Crypto Asset Valuations

As an emerging, disruptive technology that’s value isn’t yet fully understood or demonstrated, it’s increasingly difficult to give each individual crypto asset a valuation. This creates wild price volatility led by speculators working through natural price discovery.

The report, penned by researchers Sherwin Dowlat and Michael Hodapp, is a deep dive into cryptocurrency market valuations. The duo used a combination of peer-based metrics, quantity theory, discounted cash flow models, and economic forecasting to come up with their valuations.

Satis Group’s research suggests that Bitcoin (BTC), the original cryptocurrency created by Satoshi Nakamoto that started it all, will unsurprisingly continue to reign supreme. They project that it will be priced at $96,000 by the year 2023, and could reach nearly $144,000 before the end of the next decade (sorry, McAfee).

The next highest value cryptocurrency is Monero (XMR), which Satis predict could reach over $18,000 within five years. By 2028, XMR is estimated to be worth as much as $39,000 according to the report. Satis suggest the “largest upside” in the “entire crypto asset market” is in the privacy sector. The firm believes that the network effect, similar to what’s happened with Bitcoin since its inception, would be repeated with the dominant privacy coins.

Zcash (ZEC) and Dash (DASH) are right behind Monero with five-year valuations of roughly $4,400 and $1,900 respectively. In 10 years, Zcash could be valued over $9,000, while Dash would come in just under $3,000.

Litecoin (LTC) is predicted to never again reach its all-time high price of $375, with its 10-year outlook performing at just $225.

Statis does believe that Ethereum will rise from here, peaking in 2019 at $882, then dropping roughly $100 per three, five, and 10 years out.

Other entries from the current cryptocurrency market top 10 will suffer far worse fates than Litecoin and Ethereum. These will not only decline in value and never reach their previous all-time highs, but will see their prices drop significantly lower than their current bear market prices.

Ripple (XRP) for example, will end up valued at $0.004 in 10 years, according to the data. Stellar (XLM), which shares the same founder as Ripple, Jed McCaleb, will see consistent prices between $0.01 and $0.02 over the next 10 years. Cardano (ADA) shares a very similar fate, dropping to $0.0001 10 years out.

That leaves just EOS (EOS) and Bitcoin’s hard fork, Bitcoin Cash (BCH). EOS oddly drops off to an estimated $0.05 a year from now, only to reach lower than current prices of $4.50 and $4.80 in five and 10 years. Unfortunately for frontman Roger Ver, Bitcoin Cash will fail to see prices over $1,000 again, and won’t come close to its previous all-time high of $4,330. Satis suggests Bitcoin Cash will decline to as low as $268 in 2023, and only $180 in 2028.

Satis Research: Upside (5 Year) in BTC ($96,000), XMR ($18,000), and DCR ($535); Downside in BCH ($268)

Bloomberg released a research report about the valuation of cryptoassets. This is the fourth part of a five-part series (on the cryptoasset market) that has been prepared by premier ICO advisory firm Satis Group.

The report describes three valuation methodologies for cryptoassets (excluding stablecoins):

Top Down (“using the quantity theory of money to deduce the value of cryptoassets needed to support a forecasted economy)

Peer-Based (“using multiples of network-specific metrics to arrive at relative valuations”)

Bottom-Up (“using discounted cash flow models to estimate value of networks that provide yield”)

It also shows how each of these three methodologies may be applied to various types of cryptoassets. More specifically, it shows these examples:

Using Top Down for “Currency, Platform, Privacy, Other Utility Sectors”

Using Peer-Based for “Platform Sector, Exchange Sector”

Using Bottom-Up for “Currency / Privacy Sector hybrid (e.g. DASH), Exchange Sector (e.g. BNB), Other Utility Sector (e.g. REP)”

The authors of the report recognize that these valuation methodologoies are not a good way of predicting prices in the short term, but they “believe over a longer time period, and especially as the industry matures, fundamental valuation techniques will begin to more closely approximate trading prices.”

Finally, here are the main takeaways from the report:

They “estimate the amount of cryptoasset market value needed to support economic activities to expand from ~$500B next year to $3.6T in 2028”

“90%+ of cryptoasset value will be derived from penetration of offshore deposits in the next decade”

“Currency and Privacy networks will be the largest beneficiaries, as most fundamental value will stem from store of value use cases”

“Upside” (five year) in Bitcoin ($96,000), Monero ($18,000), and Decred ($535), “cryptoassets which apply unique value propositions within deep and viral markets”

“Downside” (five year) in Bitcoin Cash ($268) and “cryptoassets which attempt to inherit brand recognition and provide minimal technological advantage to incumbents”

“Little value” (five year) in XRP ($0.01) and “cryptoassets which are misleadingly marketed, not needed within their own network, and have centralized ownership / validation”

They believe that most “Other Utility” application-specific networks “hold very little value, in their current construct.”

Bloomberg Publishes Report Touting Cardano and Monero as Most Valuable Cryptocurrencies of the Future

An analysis of the universe of leading cryptocurrencies published by Bloomberg, and compiled by analyst Sherwin Dowlat of the Satin Group, has just been released. And its conclusions will make for particularly interesting reading for followers of the Cardano project.

Adopting a multi-pronged approach to its analysis of the leading cryptocurrencies which serve either as stores of value or primarily as utility tokens, the report covers metrics such as economic velocity and implied velocity, and anticipates strong potential upsides for ADA over the longer-term provided certain conditions are met.

MONERA TO CAPTURE LION’S SHARE OF ILLEGAL ACTIVITY

At the same time, Dowlat outlines that his forecast for most utility tokens is not optimistic, even for those coins which experience reasonably successful adoption.

Dowlat also studies the upside potential of privacy currencies, specifically Monero and ZCash, performing a direct comparison of what are arguably the world’s two leading anonymity cryptocurrencies. The report concludes that markets for both these currencies will likely be driven first and foremost by illegal activity, although Dowlat also concludes that Monero will likely make for the bigger beneficiary of the two – “the Privacy market user base will most likely rely on networks that have more active codebase development,” he states – with XMR likely to capture 60% of the market with ZCH catching just under a third of that figure.

However, the report does work from a number of assumptions and is unclear as to why or how high velocity coins may still struggle to gain in value over the longer term. The author points out, however, that the views expressed are uniquely his own, and also comes to the conclusion that there is long-term upside for both BTC and ETH.

Wow. Lets keep this simple. Who the hell is Aamir Kapoor? I am very sorry Aamir Kapoor, however you know absolutely nothing about blockchain, cryptocurrencies, or fintech. Case closed.