According to the last report, Micron’s shares went down due to Bear Market. Todd Gordon, technical analyst and founder of TradingAnalysis.com, said that “I think Micron is facing a technical problem,”. The reason for this decline is predicted to be the effects of US-Chinese tariffs and a bad sales interruption. Micron’s stock fell 34% from its recent high in May. Micron did not stay with it, and it suffered more damage on September 20th.

What Is The Explanation?

What Is The Explanation?

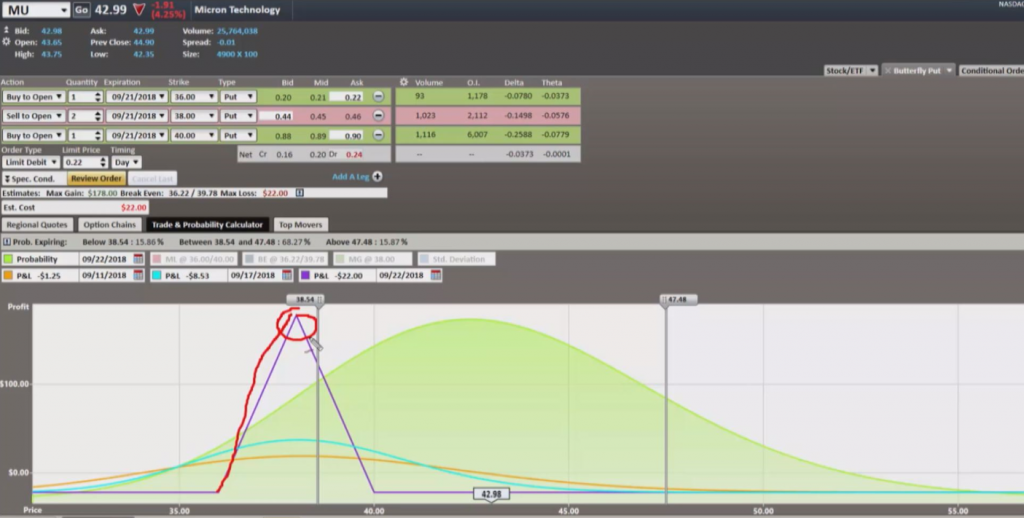

“We can see that from the most recent swing, Micron has broken support. If you zoom here, it doesn’t matter where you draw the trend line. If you go from this low in February, support is broken. If you go up here and catch the low in May and then up in July, support is broken. We have retested and dropped down. What I’d like to do is try to get down to some support levels just at around the $38 region” Gordon said.

Plans

Micron took $ 21 per transaction with the aim of preventing this damage. It has turned its perceptions to another direction and plans to mitigate the harm with new initiatives.

“We have max profit right up here at the middle of the butterfly, that’s the $38 region there if we finish there on earnings, and then we start to lose profitability as we move up toward $40,” he said. Micron shares closed about 3% lower on Tuesday, at $ 43.60 per share.