Hank Paulson expressed this situation in a differet way. Hank Paulson was the former secretary of the US treasure. Hank Paulson called it “an economic September 11”.

According to the information we find in our current research; Lehman Brothers was a Wall Street investment bank. The 155-year-old Brother Bank of Lehman was bankrupt on 15 September 2008.

This can cause many institutions to suffer. This economic crisis can be very impressive. Governments and central banks have started to research and work on this issue. According to the research done by the government and the banks, trillions were needed to get rid of this crisis. They have never had such a risk since 1929. We can call this crisis as a global crisis.

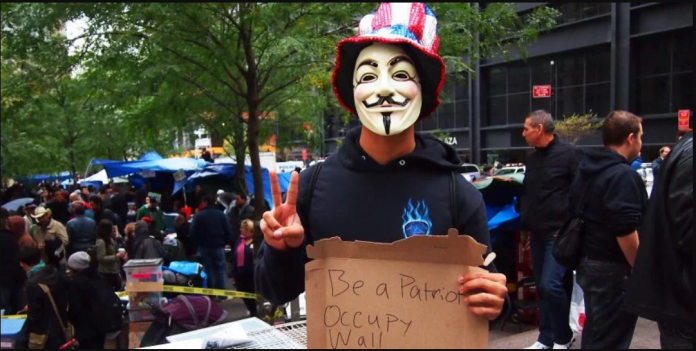

Wall Street executives were supporting the system. But research shows that these managers are still helping millions of taxpayers finance these bonuses. The managers have entered this difficult situation. They even had to sell their houses. But they’re collecting billions of dollars in bonuses.

Despite all this, in a short time something new came to the fore. After Lehman’s bankruptcy, a new technology emerged. Nobody has noticed this piece of technology in these complex events. On October 31, 2008, an unknown person named Satoshi Nakamoto appeared in the woods. Nobody has known this person before.This person has published Bitcoin’s white paper on a cryptography mailing list.

When the incoming mail was examined, people were surprised. Because it was a new technology. According to the new system, payments made between two people would not be in financial institution. In other words, payments made on the internet will be transmitted directly to the other side. There will be no any financial institutions.

The founder of this new system, Satoshi Nakamoto, had already found it and designed it. It means, before Lehman declared bankruptcy, Satoshi was working on this technology. This new technology will be a launch. According to Cornell computer science professor and blockchain researcher Emin Gun Sirer, they have to wait for the right time to launch.

Sirer made an interview with CoinDesk. Sirer said that; “It’s very clear that Satoshi was affected by the events that led up to the financial crisis of 2008, and then it’s obviously recorded in the genesis block as well.”

There was a headline. A headline was written on January 3, 2009. This headline criticized Bitcoin roughly. This headline was written by Times of London. In response to all this, Sirer said: “Chancellor on brink of second bailout for banks.”

Bitcoin was spreading every day and everybody noticed it. Some people thought different things because Bitcoin grew so fast. Bitcoin is a good choice for most central banks.

There were some doubts in mind because of this crisis. Most finance institutions have promised that they will come from the top of this crisis.

Nowadays, in the world of crypto money, people can buy real things. It sounds interesting to get real stuff in crypto money. For example, there is a platform called ‘Bitcoin Pizza Guy’. This platform is proof of what we say. The owner of this platform is Laszlo Hanyecz. Laszlo made a speech to CoinDesk. According to Laszlo, banks can take the place of Bitcoin.

But it does not seem to make much sense. Today, Bitcoin and Bitcoin’s currency has gone a long way. Bitcoin has built up block chains and continues to grow professionally. Now it is making deals with big companies and banks. Nobody could have guessed these agreements would happen.

If we were to look at the relationship between Wall Street and the crypto currency, we can not say good things. It’s hard to think of a good deal because of the events that happened in the past. But that may surprise you. Big financial institutions have begun a secret deal with Bitcoin. Other big firms are also pushing for a deal in order to partner with them.

As everyone knows, there was a crisis on Wall Street 10 years ago. This crisis was due to the crypto currency. Despite all of this, is CryptoCurrency and Wall Street now agreeing again?

What do people think about bitcoin?

Bitcoin has become a traditional thing now. Bitcoin is a need as oil or water. At the first time, Bitcoin was not so important. Because they were new and not so successful at that time. But now it has become the best platform for this movement. According to Thomas, Bitcoin has made great strides and developments over the last 5 years. In 2013, Ripple said that it is one of the first thinkers to chain the block in the institutional space, and that the typical reaction to this transition is as follows: What are you doing? Do a favor to yourself. Yes, there are many banks and waiting for you. But, you do not need a bank. Try to work with someone else.

If we think realistically, for years, people have been working with banks People are putting their money in the bank. And they feel more secure. Because they trust their banks. It might be a bit unwise to choose this platform instead of the banks. Tone Vays is a crypto money investor and at the same time a crypto currency researcher. According to Tone Vays; many people do not trust these platforms yet and they are not ready to that platforms.

He added to his speech; these platforms are easier than working with banks. People can own their own banks thanks to these platforms. These platforms also have no intermediaries. It’s just you and your bank.

Most people see the crypto currency as a risk. Nic Carter, who is knowledgeable about the risk, said that; We do not think Bitcoin is a risk. Bitcoin is just a bit different from the banks. Thanks to Bitcoin the state and money became two separate things. It means that, they were independent of each other. In addition, Bitcoin can also work with banks. It is so possible.

Today, there are thousands of people who work with crypto currency. Most of these people are young. People are investigating, and they become blockchain enthusiasts. People are happy to invest in the crypto currency.

To give an example; Amber Baldet, who led JPMorgan’s blockchain program before leaving to find the start of a new block chain, noted that “early users do not have to be the same initial philosophy that seized their hearts and mind”.

Looking at all the crypto-currency researchers, Baldet, Vays and Carter had previously worked with corporations. So they had already gained experience in the banks. Now Krpto opted to be in the currency world.

According to Carter’s thoughts; bank and crypto currency can work together. It means, the banks of the future financial world and the paths of the crypto money can intersect. Because the crypto currency is growing and developing. Later on, it is possible to see the crypto currency as an institutionalized one. As a result, the crypto will act legally like a currency banker. It’s almost no difference from the banks. People will find the crypto currency more attractive. So, the crypto currency has more than a hundred kinds. Today, many people want to institutionalize the crypto currency. The crypto currency welcomes for many people.

It can be a revolution

Nonetheless, despite the possibility of rapprochement, some people on the crypto-currency platform have announced they will continue to be cautious about Wall Street and central banks and the like. There is no definite result yet.

According to Hanyecz, “The bankers are professionals and experienced in their fields, wanting to be cautious about the negative things that different markets can do, and the banks feel secure because they are under government control. He also added: “Everything for Bitcoin is legally progressing, and obviously there is no big problem for So, Bitcoin can be institutionalized.

According to Zooka Wilcox’s thoughts; People should be free in their thoughts. If the majority wants to institutionalize Bitcoin, this should be done. People are using Bitcoin. There are many platforms in the virtual ambience. Some platforms can be dangerous. If this system is institutionalized, people will feel safe. This thought may sound like a revolution. This revolution can be a good result. This changes in the world can lead to positive results. So, this revolution must be secure, controlled and systematic. Wilcox said that Cryptocurrency “started with a small group of hardcore revolutionaries”

According to the Zooka Wilcox; If we want success in the world as a revolution, it must be in accordance with political and economic logic. If everything goes with systematic conformity, the crypto currency can be a revolution.

As a result, there are people who think positively and negatively about Bitcoin. Overall, Bitcoin users are increasing day by day. Now, Bitcoin users are getting away from the banks. Bitcoin is growing and improving itself. The banks should consider working with Bitcoin. If Wall Street banks and Bitcoin accept to be a partners, very good results can be achieved. Of course that is not definite. People need to think well.