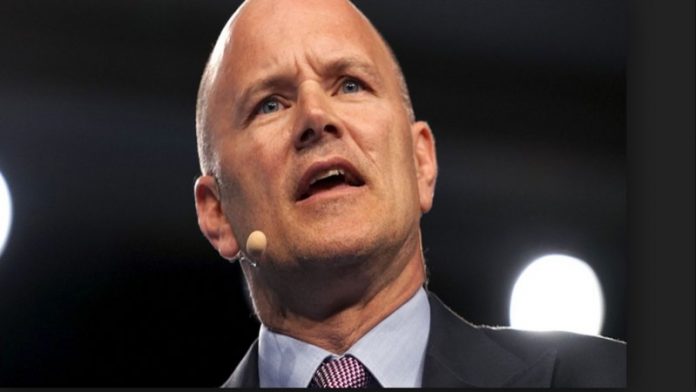

In the mix of wild volatility in Marijuana shares last week, ex Goldman Sachs macro businessman Michael Novogratz shorted Tilray but feels the Marijuana sector will prosper.

“Listen, the weed business has a great underlying story, a lot like cryptocurrency. In five or six years, we will have a monster weed business.”

Tilray Stock Performance

Stocks of Tilray, a Canadian Marijuana Firm, declined significantly on Friday, marking the end of a week that enticed investors. The Tilray stock market closed at 30.3% less and dispatched sharp trends throughout the week. Besides, it was ranked as the worst-performing stock in the ETFMG Alternative Harvest ETF (MJ), which dropped by 7%.

On 17th September, Tilray stocks experienced a 10% increase followed by surges of 29% and 38% on the next two days respectively.

The trend was partly influenced by Tilray’s report on 18th September that the US Drug Enforcement Administration accepted its request to export a cannabinoid research drug into the US from Canada for a clinical test.

Novogratz expressed that he could not assist but enter into the mix and short Tilray- a statement he uttered on 20th September at the Yahoo Finance All Markets Summit.

Novogratz’s View on Bitcoin

Novogratz has not dropped his bullish character on Bitcoin and the entire crypto world and projects a strong market rally at the beginning of next year. “I do think bitcoin is going to be significantly higher by the end of the year,” stated Novogratz, adding he could not be upset if it doesn’t reach $6800 or $8800 within the next three months.

In November 2017, Novogratz told CNBC that BTC could “easily” reach $40,000 by the end 2018. In addition, he also projected Ethereum to be valued at $1,500. Nevertheless, these two projections did not come to pass as BTC has declined by almost 50% while ETH has also declined by 83% from its best hit in January.