Eight of the market’s highest volume 10 crypto currencies declined. IBM, the world’s leading IT technology company, has announced a new collaboration with Singapore-based shipping company Pacific International Lines (PIL), aimed at digitizing the bill of lading via blockchain technology.

In addition to IBM, the Malta Financial Services Supervisory Authority approved the first European-centered and regulated crypto-currency fund for financial products and companies based on blockchain technology and main crypto currencies, giving licenses to the ConsulCoin Crypto money Fund.

Please enter CoinGecko Free Api Key to get this plugin works.While the market increased with a market volume of 113 billion 848 million dollars, Bitcoin declined by 0.09 percent in the last 24 hours to $ 6,578.

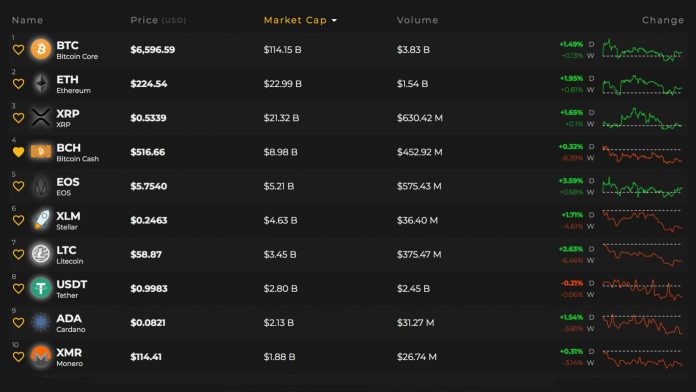

Only EOS and Tether increased by 1.64 percent and 0.06 percent in the last 24 hours from the market’s highest volume 10 crypto currencies. Among the highest volume 100 crypto currencies, while 57s declined, the downward trend was driven by Siacoin (35.4 percent).

As a result of the developments, the market volume decreased to 218 billion 741 million dollars and 24 hour trading volume in the market was calculated as 12 billion 28 million dollars.

Changes to the highest volume 10 crypto currencies (sequence numbers, position of units in the rankings):

1.Bitcoin 0.09 percent

2.Ethereum 0.90 percent

3.Ripple percent 2.86

4.Bitcoin Cash 1.90 percent

5.Stellar 0.54 percent

6.Litecoin 0.80 percent

7.Cardano 0.86 percent

8.Monero with 0.32 percent drop

9.EOS 1.64 percent

10.Tether increased 0.06 percent.

EU’s Financial Authority to Increase Budget Separated to Crypto Money Surveillance

The unit responsible for the financial markets of the European Union has started special efforts to follow up the crypto coins.

A few days ago, the European Securities and Markets Authority (ESMA) published a new program covering 2019. ESMA, in this program published in the next year to work in what areas, which areas will follow closely.

ESMA has announced that it will follow crypto coins to maintain the financial order in the EU during the next year. In addition to following the crypto money market, ESMA stressed that it will also investigate the risks of the crypto money sector.

According to the program, ESMA will have more than 1m euros to invest in crypto coins and the fintech sector in the coming year.

ESMA summarized its objectives for the next year in the program it publishes:

‘‘To approach innovative financial activities in a balanced manner both within the scope of regulation and supervision, and to make recommendations to EU institutions, market investors and consumers.’’

ESMA, which is obliged to regulate the financial markets in the EU, will be considering the Financial Product Markets Directive (MiFIR) within the EU while examining the crypto money sector.

MiFIR is a directive that specifically deals with difference contracts (CFD) and binary options. Through this directive, organizations within the EU can limit or even prohibit the sale and promotion of binary options offered to individual investors.

In January of this year, the ESMA polled the public opinion on crypto-money-based difference contracts. At the time, ESMA was investigating the possible use of the products in question and whether they would comply with existing laws.