Table of Contents

Cleaning Problem

Beyond the costs for the issuers themselves, this system led to a large increase in brokerage costs of over $ 100 billion in service fees after each tear. Finally, there is a property issue that should be overly familiar with crypto-paratrooper enthusiasts who are addressing rationality: If you are not the owner of the private key, you don’t have your bitcoins. It is revealed that the shareholders do not own the shares and that the DTCC has 99 percent of the shares.

As you think, If a broker goes bankrupt, it’s easy if it just takes shares and distributes them back to customers. This means that an individual share acquired by the DTC will not be associated with an individual shareholder (as we have established). Due to the complexity of the system, we have spent about 4,000 words so far, and SEC 4 imbalances can occur.

Please enter CoinGecko Free Api Key to get this plugin works.2008: Beyond Brokers

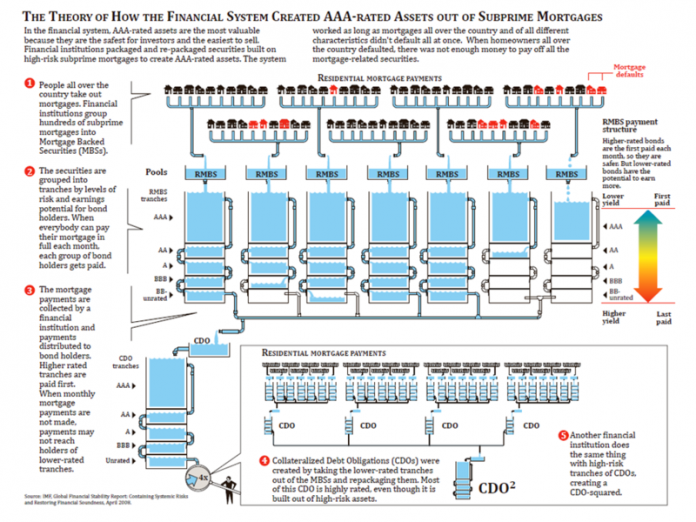

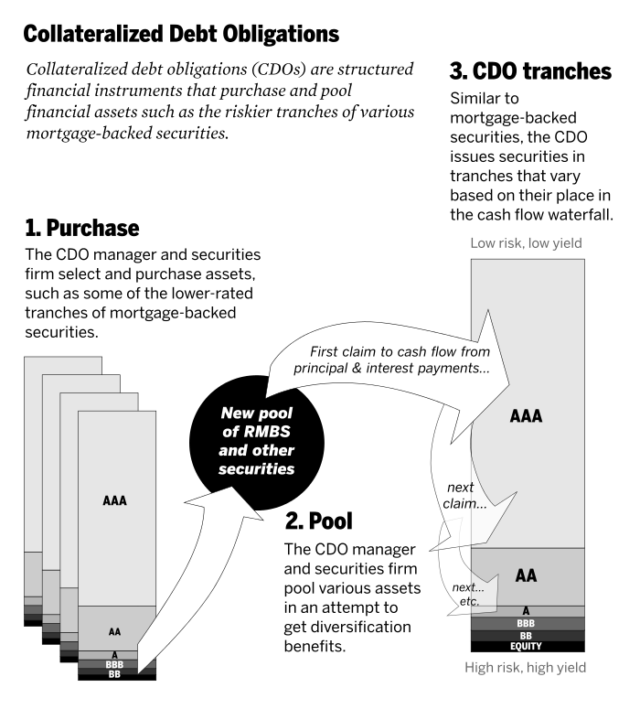

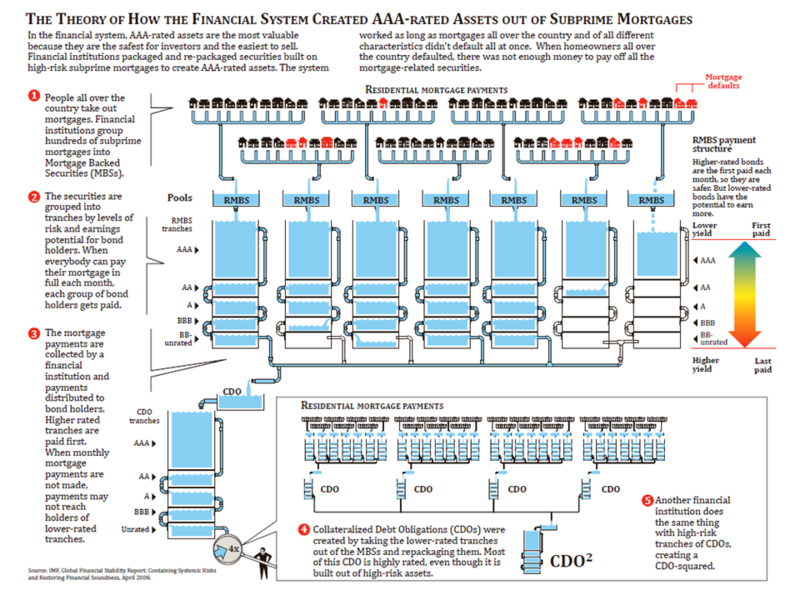

The reason for this is that it returns to something that we talk about, not how multilateral stocks (other types of securities) reduce the counterparty risk. This was not the case for financial instruments causing the 2008 financial crisis. These instruments have led to a large amount of counterparty risk by the introduction of collateralized debt obligations (CDOs).

Originally mortgage loans were very simple. A buyer could go to a bank and ask for a mortgage to pay for their home for 15-30 years. Subsequently, residential mortgage-backed securities (RMBS) came in and were able to significantly increase yields without increasing the risk (0.5 percent at the time of mortgage default rates, while this rate was higher than 5 percent at the highest level. The 2008 subprime mortgage crisis). This also provides more liquidity and profit in banking.

All cash flows from underlying mortgages are combined and then paid to AAA, then AA.

Low-grade RBMS is then combined in CDOs

The bankers working on Wall Street were smart people, and they realized that the way to solve this problem was to give credit to less qualified people.

The system addressed investors by offering a R slices er system to invest in different levels of RMBS to achieve different returns. Bankers were once more confronted with a problem – demand was not enough as low – interest borrowing increased and RMBS began to consist of lower – rated securities. More importantly, it would mean high-risk mortgage lending, still at 65 percent AAA, because of the amount paid by the rating agencies to pay for these bonds (a source municipal bond is $ 250,000 for $ 50,000).

Many institutional investors have rules about credit rating bonds that are allowed to buy. Rather than attracting or retaining these loans, banks have created what is known as a secured debt (CDO).

In a bond, non-AAA assets were generally purchased by other CDOs and combined with a CDO² and consequently evaluated as AAA. This process is very well illustrated in the diagram below.

The problem with these un-funded investors was the failure of low-grade slices. No one (most of the shorts included) thought that the AAA guarantees would fail. This led to higher payments in the short term due to the fact that the asset was not likely to default.

Multilateral netting differs in swap contracts, OTC products and derivatives due to the requirement of non-funding parties and collateral requirements.

Fractional Banking and Rehypothecation

Rehypothecation is one of the biggest sources of counterparty risk in the modern financial system. Recall that there is a promise to be held as collateral to secure a loan (Wall Streets were doing in 1892 before multilateral clarification in order to provide sufficient cash to meet trade requirements.

Typically, rehypothecation works as follows:

This may continue to increase the size of the collateral chains. The problem is that if the prime broker fails, the collateral of the mutual fund can be claimed by the person to whom he sends his securities to the main broker. This brings a large amount of counterparty risk to the system and is now at the heart of the financial system. The result is that financial institutions seem to be more solvent than they actually are.

Unique Problem with Cryptocurrencies

This counterparty risk is something when talking about traditional securities. There’s something else talking about digital assets. It turns out that there are some things specific to digitally stored assets.