Ethereum Classic (ETC) in the past has been considered a fraud or dead coin. However, if the unprecedented shifts in how people perceive the coin and its general acceptance are anything to go by, Ethereum Classic might significantly affect the crypto industry.

The new developments have come just in time since the coin was at the risk of lagging behind into the cryptocurrency market just as it did last year due to breaking the market structure.

Table of Contents

ETC latest developments

The new developments include the coin’s listing on Coinbase, the previous success of the yearly ETC summit, as well as other upcoming events. Such developments have accelerated investor optimism about the potential of Ethereum Classic coin.

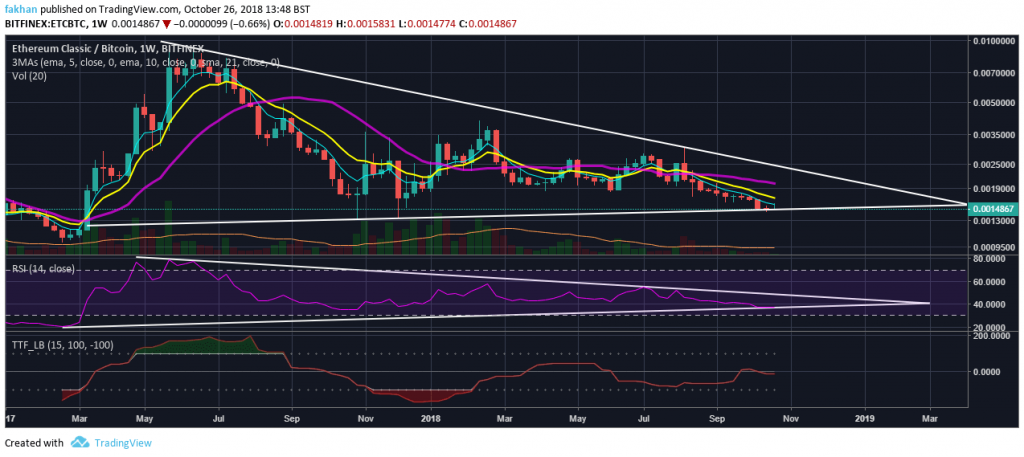

Considering ETC/USD, Ethereum Classic might attain record-breaking levels against the US dollars. The chart highlights the fact that the 10 Week EMA will hit the 21 Week EMA very soon. Such a shift might greatly affect the cryptocurrency in a positive way.

Coinbase listing

Ethereum Classic (ETC) listing on Coinbase was much different from how Litecoin (LTC) and Bitcoin Cash (BCH) were listed. In the case of the two cryptocurrencies, investors were not kept in the loop about the listing. However, for Ethereum Classic, the decentralized cryptocurrency exchange platform made the announcement way before it was actually listed.

The result of this was not many crypto users rushing to purchase ETC as in the case of Litecoin and Bitcoin Cash. The effect of ETC’s listing is yet to be fully realized and most experts are anticipating that more people will purchase Ethereum Classic in the future.

High expectations

Before the Coinbase listing, some analysts had expressed their enthusiasm for Ethereum Classic by putting a price target of over USD 100. One such analyst is Tom Lee, a Co-Founder at Fundstrat who had already announced a target of over USD 70 even before the announcement by Coinbase.

However, not all investors approve of Coinbase’s influence in the cryptocurrency market, which is mainly because they had expected the exchange platform to list Ripple (XRP) and not Ethereum Classic. Despite this disapproval, Coinbase’s influence in the market is still high and this is attributed to the fact that most coins listed on the platform have great potential to generate millions of profits to its users.

For example, in the case the case of Bitcoin Cash (BCH) and Litecoin (LTC, which were underpriced compared to most cryptocurrencies at the time of listing on Coinbase, the coins had the most potential to increase their prices to the highest levels.

Ethereum Classic aims at not just being one of those cheap cryptocurrencies in the market but a cryptocurrency that provides real solutions to real-world challenges facing the industry. Similarly, its main objective is not making numerous profits by hosting multiple ICOs on its blockchain network but providing a stable blockchain network that has the capability to operate IOT (Internet of Things) applications.

Final thoughts

Although there are many other blockchains that can run IoT applications, Ethereum Classic is one of a kind since it will offer users with decentralization and immutability of data, which are some of the key features that guarantee the success of decentralized applications.

Importantly, Ethereum Classic can be considered as a worthwhile financial investment due to its limited supply that will result in an increased demand and subsequently increase its value in the future.

Chart images from TradingView

This article should not be used as a direct trading or investment guide.