A report, published in October by OneAlpha revealed that Bitcoin’s market was gaining strength after the 2018 correction. The stability of the last weeks is a sign of maturity of the markets that seem to have passed the hype stages -both bullish and bearish- of the previous months.

Bitcoin (BTC) Price Today – BTC / USD

Please enter Coingecko Free Api Key to get this plugin works.

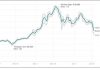

Bitcoin Price Weekly Analysis: BTC/USD Rebound Faces Significant Hurdle

Key Points

Bitcoin price recovered recently and tested the $6,375 resistance area against the US Dollar.

There is a significant bearish trend line in place with resistance at $6,400 on the 4-hours chart of the BTC/USD pair (data feed from Kraken).

The pair must break the $6,365, $6,375 and $6,400 resistance levels to trade higher in the near term.

Bitcoin price is still above the $6,250 support against the US Dollar. However, BTC/USD is facing a crucial resistance near the $6,375-6,400 area.

Bitcoin Price Analysis

This past week, there was a downside extension below the $6,300 support in bitcoin price against the US Dollar. The BTC/USD pair traded close the $6,200 support where buyers emerged. As a result, the price started a decent recovery and moved above the $6,250 and $6,300 resistance levels. The upside move was positive as there was a break above the $6,340 level as well. Besides, the price surpassed the 61.8% Fib retracement level of the recent decline from the $6,429 high to $6,201 low.

However, the upside move stalled near the $6,375 resistance and the 100 simple moving average (4-hours). Moreover, the 76.4% Fib retracement level of the recent decline from the $6,429 high to $6,201 low acted as a resistance. To the topside, there is a significant bearish trend line in place with resistance at $6,400 on the 4-hours chart of the BTC/USD pair. At the outset, there is a contracting triangle forming with resistance near $6,360. Therefore, the price needs to surpass the $6,360, $6,375 and $6,400 resistance levels to trade higher.

“The December 2017 and January 2018 boom and bust had a cleansing effect on the ecosystem”

“Currently, Bitcoin is gaining strength,” Report by OneAlpha says

Ethereumworldnews: OneAlpha is an Israeli firm part of First Digital Assets Group; a fintech that defines itself as “the leading digital assets group in Europe.”

OneAlpha Report: Bearish Trend Is A Good Thing For The Market

According to the report, the current bearish trend was necessary. This decline in the markets served as a “relief” and generated a “cleansing effect” on the ecosystem.

The facts seem to prove the OneAlpha team right. After the abnormal bullish streak of 2017, many people entered the market in an abrupt and immature way. The 2018 correction seems to have given Bitcoin back the stability needed to gain more credibility as a “market” instead of its previous “bubble” image:

“From our perspective, the prolonged bear market provided the sector with a much-needed relief, lowering valuations to a more sensible level. Despite the considerable correction, a large portion of the value represents the future potential of the network rather than its current one. The December 2017 and January 2018 boom and bust had a cleansing effect on the ecosystem, removing many of the speculators and leaving mainly real investors, operators, and builders in the market. This is what was necessary to move forward and build a successful ecosystem.”

Bitcoin: Best Currency / Ethereum: Best Platform

The report is clear in dividing the cryptocurrency market into different branches. The first one is composed of well-known cryptocurrencies. For OneAlpha, 2018 has been a year during which Bitcoin has strengthened, recovering part of the influence taken away by other altcoins:

“Currently, Bitcoin is gaining strength and captures more than half of the total crypto market cap. Ethereum captures 10% of the total market cap. There are currently more than 2,000 traded crypto assets and more than 1,000 unique tokens worth around $14 billion. 87% of the tokens are Ethereum based, with NEO and Waves capturing around 2.4% each …

Of this valuation, it is noticeable that Bitcoin captures about 71% of all currencies and Ether 54% of all platforms.”

An Optimistic View Of The Future

The Report also highlights the importance that ICOs have had in increasing interaction with the public (despite cases of fraud and constant failures). It also points out the increase in institutional investments and blockchain technology patents registered in China and the United States.

The report gives a fairly positive view of the situation considering the facts from a broad perspective. Market behavior in 2018 is, according to analysts, a natural and necessary reaction to the craziness of 2017:

“We are experiencing a phase of sobriety and maturation – a decline in retail investment and a more careful, responsible approach from institutional investors on one hand and regulators around the world on the other. A long bear market might be the ideal climate to let the dust settle and examine, both internally and externally, the true possibilities that lay within the cryptocurrency and blockchain ecosystem. Ultimately, the goal is to take a step further and bridge the gap between consumers, traditional investors, and blockchain technology.” Keywords: bitcoin price today, bitcoin price live, bitcoin price history, bitcoin news, bitcoin price usd