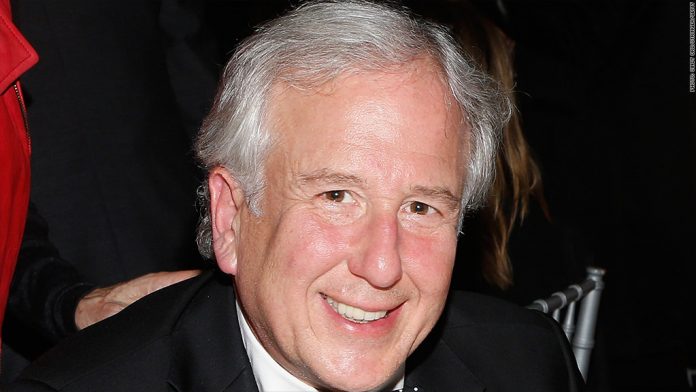

In the midst of 2018’s market tumult, the ex editor-in-chief, Matt Winkler, recently had a conversation with the outlet’s Emily Chang about cryptocurrencies and Bitcoin (BTC).

In a short conversation, Winkler, a well-known reporter in the business sector, explained that Dotcom startups were valued by their cash earnings.

The reporter explained that it is difficult to value cryptocurrencies by their “intrinsic worth,” and that commentators do “mental gymnastics” to decide target prices for this asset class.

In addition, Winkler said that “even warren Buffet” has lambasted cryptos, such as Bitcoin, maintaining that they are assets that don’t have exact value.

When Winkler was questioned if BTC could recover, Winkler answered stating that: “I’m not clairvoyant and I think that this answer is way above my pay-grade. What I can do as an observer, newsman is to look at this and say what justifies its valuation which we see in the marketplace. And when it’s difficult to find the answers, you ought to be pretty cautious”.

Bloomberg bashed as Crypto “FUDders”

Winkler is not the only Bloomberg reporter that the crypto’s community had lambasted. Mike Dudas, a Well known Fintech entrepreneur, who is currently the CEO of the block, drew people’s attention to Bloomberg’s recent news on Bitcoin being a bubble.

Mike Dudas, who is known for industry-skepticism and optimism, exclaimed that the New York outlet has been rifling out the crypto “op-ed FUD.”

Armin Van Bitcoin quipped that Bloomberg reporters believe that global debt is not a concern; centralized parties should take charge of monetary supply.

The crypto advocate also noted that the site’s coverage of Bitcoin has been shoddy, that employees are rewarded to “move markets.”

Recently, others bashed the anti-crypto ATM piece of Bloomberg. It is becoming obvious that the most famous participants in crypto have issues with Bloomberg, as some are scared that the organization is in collaboration with centralized financial institutions.