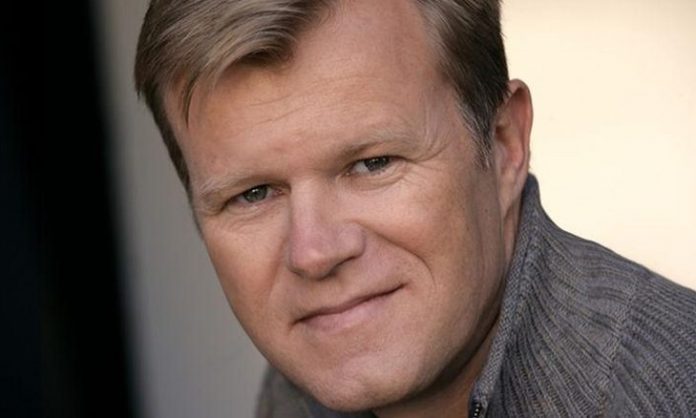

Michael Casey, a well-known author, chairman of CoinDesk’s advisory board, and the co-founder of Network Effects Media, on Thursday sat with Cheddar (an up and coming business media outlet), to discuss the state of the crypto industry, as well as other unique topics.

A Cheddar anchor, questioned Casey if cryptos are facing a crisis as a result of the way crypto investors value digital assets like Bitcoin (BTC) or Ethereum (ETH). Giving a passionate response, the crypto proponent, who contributes regularly to CoinDesk, noted that this valuation of market models is “all just a bit backward.”

Explaining further, Casey noted that cryptos and related techs are seen as a way to disintermediate ecosystems and to curb centralized entities. But now, the way these blockchain-based assets are valued is quite reminiscent of how traditional markets are run — a big no-no for diehard decentralists.

In addition, he said that we’re benchmarking the performance of crypto of fiat, or more specifically, we are continually denoting the value of BTC in dollar signs, in other words, he said that the most part of the crypto market is aimed at having a successful exit into fiat, instead of maintaining skin in the game.

Casey added that this leads to incentives getting misaligned, as investors look to make gains, rather than oust the often corrupt powers that be.

Case in point, the Bitpay CEO of recent informed CNBC that much of the price of Bitcoin is based on speculation, rather than legitimate use in the real world.