Before going through the positive prediction, we would like to inform you about negative predictions as well. So you can decide independently.

$BTC – Daily close

Notice the long wick, a nice sign of a slight retrace likely

Would like $BTC push up slightly higher to at least $4100 to mid $4ks would be a nice a target

For traders – this is good volatility

For Holders – you could see new lows in the coming weeks pic.twitter.com/AYmZzV8v4h

— Josh Rager 📈 (@Josh_Rager) February 20, 2019

Josh Rager, another popular cryptocurrency analyst on Twitter, recently said that he thinks Bitcoin needs to break above $4,100 in order to move firmly into the mid-$4,000 region, but also noted that it could easily see new lows in the coming weeks.

“$BTC – Daily close… Notice the long wick, a nice sign of a slight retrace likely… Would like $BTC push up slightly higher to at least $4100 to mid $4ks would be a nice a target… For traders – this is good volatility… For Holders – you could see new lows in the coming weeks.”

Flood, an extremely popular cryptocurrency trader on Twitter, told his over 60k followers that he thinks BTC will drop to $3,800 before continuing to surge, but further adding that a drop below $3,700 would likely lead the crypto back towards its support levels in the low-$3,000 region.

“I’d imagine we see a sweep of 3800 in order for larger players who missed the move to fill up on some longs and reduce some short hedges. This should be followed by a sharp bounce… $BTC seems fairly bullish here, but if 3700 breaks I wouldn’t stay in any longs,” he said.

I'd imagine we see a sweep of 3800 in order for larger players who missed the move to fill up on some longs and reduce some short hedges. This should be followed by a sharp bounce. $BTC seems fairly bullish here, but if 3700 breaks I wouldn't stay in any longs… pic.twitter.com/eub2NVgzM8

— Flood [Deribit] (@ThinkingUSD) February 20, 2019

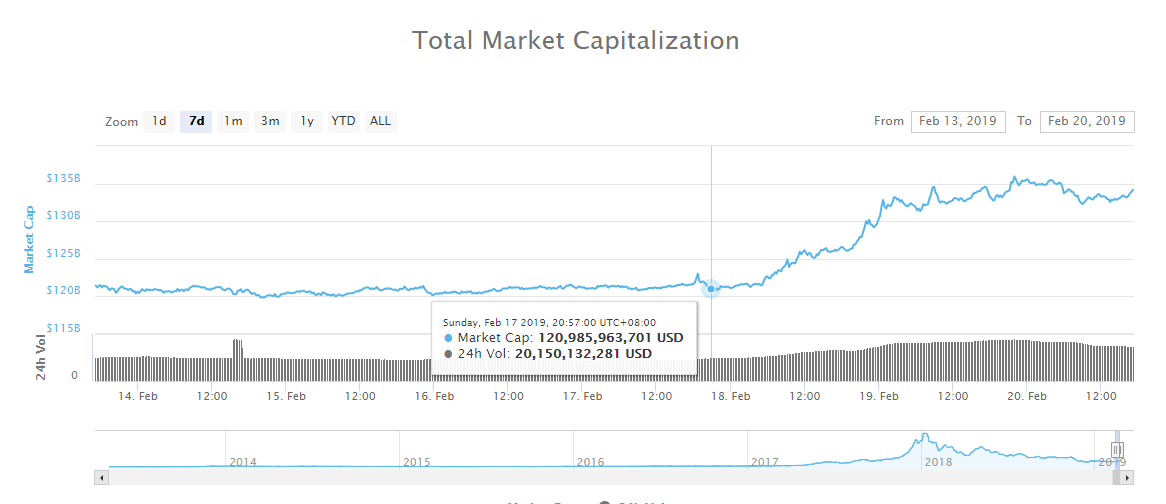

In the past 48 hours, the valuation of the crypto market increased by $13 billion as Bitcoin moved rapidly from $3,600 to $3,900 by 10 percent.

Traders are expecting a near-term pullback following a strong movement in the cryptocurrency market.

But, economist and analyst Alex Krüger foresees the Bitcoin price surging fast beyond key resistance levels if the dominant cryptocurrency is able to break out of the crucial $4,200 mark in the weeks to come.

The time frame during which Bitcoin can initiate a speedy rally from $3,900 to $4,200 remains unclear as the daily volume of the cryptocurrency market has noticeably declined since its initial spike on February 18.

BITCOIN TO $4,200 IS KEY, WHAT ARE SOME FACTORS THAT COULD FUEL IT?

As Su Zhu, the CEO of Three Arrows Capital, recently said, there currently is more than $2 billion in fiat sitting at exchanges, stablecoins, and crypto funds.

No additional capital from a new group of investors such as institutions is necessary for BTC to initiate a proper trend reversal in the foreseeable future.

Existing capital in the cryptocurrency market is sufficient to trigger a major rally that could allow BTC to revisit crucial levels in the $10,000 to $12,000 range.

Theres an estimated $2B in cash sitting at crypto funds/holdcos. Theres another $2B+ sitting in stablecoins, and another $2B sitting at exchanges/silvergate/signature.

This is $6B fiat already onboarded to crypto to buy your bags. Imagine thinking we need new money to hit $10k.

— Su Zhu (@zhusu) February 18, 2019

Hence, Krüger explained that given the chart of Bitcoin has all signs of a bottom, technical factors may be enough to push BTC above the $4,200 resistance level in the near-term.

The analyst said:

“The BTC chart has all the components of a bottom. Capitulation (Nov to Dec), bounced off long term trend measure, twice, on Dec & Feb (200 WMA), broke out from higher low in high volume (Now). A flush down on the last push lower would have increased bottom odds. Strong move up to fill in the gap above is a matter of when not if. Such move up can happen entirely on technicals i.e. it does not need a fundamentals catalyst nor a change in market structure.”

If technical factors of Bitcoin successfully fuel a short-term rally, BTC could break $4,200, which Krüger sees as one of the most important resistance levels that may allow the asset to initiate a rapid movement to the upside.

Many fundamental factors that may potentially contribute to the short-term rally of BTC also exist. By the end of the first quarter of 2019:

- ICE’s Bakkt is scheduled to launch its Bitcoin futures market

- Fidelity is set to operate a regulated cryptocurrency custodial service

- Nasdaq will have launched Bitcoin and Ethereum indices that could open doors to a wide range of investment vehicles.

This is big news. The launch of Nasdaq crypto indices could lead to regulatory approval for crypto-based derivatives in the market.

And as a direct initial effect could mean more interest from institutional traders.

The feeds are going live Feb 25th.

— Alec Ziupsnys (@AlecZiupsnys) February 18, 2019