MarketWatch Analyst John Mauldin says: When the U.S. falls into a recession, a credit bubble will explode. As the economy enters recession, many companies will lose their ability to service debt.

Table of Contents

Not business cycles; we have credit cycles

Peter Boockvar, chief investment officer of Bleakley Advisory Group, a $3.5 billion wealth-management firm, which drew an enormous amount of interest says: “We no longer have business cycles; we have credit cycles.”

- Corporate debt issuance, especially high-yield debt, has exploded since 2009.

- Tighter regulations discouraged banks from making markets in corporate and high-yield debt.

Both are problems, but the second is worse. Experts tell me that Dodd-Frank requirements have reduced major banks’ market-making abilities by around 90%. For now, bond market liquidity is fine because hedge funds and other non-bank lenders have filled the gap.

Growing economic bubbles

Lyn Alden, investment strategist gives examples of 4 growing economic bubbles:

Student loan debt

The cost of higher education in the country has increased 4-5% per year over the last decade, dramatically outpacing inflation. The federal government has expanded its loan asset balance by more than tenfold in the past decade, from around $100 billion to over $1.2 trillion.

Per capita healthcare costs

Healthcare spending continues to grow at nearly 6% per year. But not the quality of life. Healthcare spending as a percentage of GDP was 12% in 1990, and it’s now up to 18% of GDP just a quarter century later, according to the Centers for Medicare and Medicaid Services. This is expected to increase to over 20% of GDP by 2025.

Unfunded state pension liabilities

According to Moody’s, the combined sum of state pension unfunded liabilities is $4 trillion, and even in the “best case” scenario of stock returns over the next few years, liabilities won’t go down.

In fact, according to the same report, if markets stay flat in 2019, there would be a 59% jump in unfunded pension liabilities.

The Federal Reserve estimates the unfunded liabilities at $4 trillion and growing.

Federal Debt

A country can increase its debt forever and never go bankrupt, as long as its economy keeps growing.

The key is that debt as a percentage of GDP has to be stable. For example, if the GDP and tax revenues of a country keep growing by 3% per year, and their outstanding debt keeps growing by 3% per year, then their debt as a percentage of GDP will remain stable over time. The debt stays a consistent fraction of the economy.

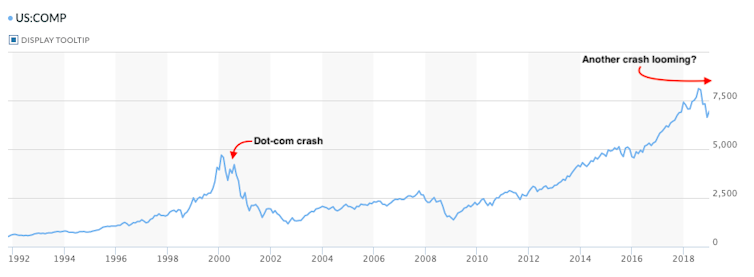

Is the Stock Market Crashing?

According to many analysts, economists, traders and investors, stock market is surely going towards a crash if compared to the last major crash of the stock market back in 2009.

Ten years later, the market is once again showing warning signs, with many investors indicating that the market will be pushed towards another crisis due to cheap credits and high interest rates in oppose to the 90’s crash driven by the internet bubble.

One of the firmest indicators that the market is going towards yet another crash is the fact that 2018 has been the most volatile year since the 2009 market crash, which indicates that the crash is more likely to happen 10 years later.

2018 the Most Volatile Year Since the Crash in 2009, Indicating Potential Crisis in the Market

As Dow Jones Industrial average fell by 420 points, which is around -2%, many investors are certain that another crisis will hit the market already by the end of 2019 or the beginning of the next year.

Investors and economists are stressing out the importance of signs in the market that indicate a potential crash that is more likely to take place with the rising interest rates and the notably increased volatility.

Based on the latest report, the majority of analysts believe that the market is probably going to fall by -70%, despite the fact that the US has the strongest economy in the last 40 years.

Scott Minerd believes that the market is going to arrive already in 2019, while he expects to see equities going up, and Paul Tudor Jones stated on the matter of the upcoming crash that he sees the recession arriving by the beginning of 2020, as he added that “we are playing an age-old storyline of financial bubbles”, as seen many times before.

Ray Dalio, on the other hand, believes that the market is already in a pre-bubble state, waiting to make a transition already by the beginning of the next year.

What Caused the Stock Market Crash of 1929

The widely known saying dictates that the history is our teacher, which can also be applied to the stock market predictions as well, which is why the notorious market crash of 1929, still matter even beyond the history.

The stock market crash back in 1929 was followed by the Great Depression, and as the historical day known as “Black Monday” is a long way from being forgotten, market analysts and historians following up with financial market are learning from the Great Depression by tracing the factors that caused the stock market crash in the first place.

What Caused the Notorious “Black Monday” of 1929?

After collecting significant gains throughout the period of from 1921 to 1929, known among historians as “the Roaring 20’s”, the stock market fell by 13% in a single day by the end of October 1929.

Within the period of booming prices in the stock market, Dow Jones Industrial average recorded an impressive performance in the stock market, allowing the average to reach 381 points starting from 63.

Even though the general opinion states that the Great Depression came in the course of a single day, this is not the case, as it took more than several days to get to the point of a major crash.

Only several days before the crash that became the most obvious within the period of two days, October 28th and October 29th, 1929, the market actually showed an amazing performance, collecting rises, however, this was only the case because investors were trying to stabilize the market by rallying up on stocks on the last Friday before the crash took place.

Although the 20’s were the years of great economic expectations and even greater predictions, the case was that the stocks were highly overvalued as more investors were raising credits in order to invest and buy more stocks, which eventually led to the crash.

Factors such as high corporate and consumer debts, unregulated industries, leverage, and investors’ speculations are what pushed the stock market towards the Great Depression, while many economists have in mind a mild version of 1929 crash that could take place 90 years later.