Pinterest managed to attract 250 million active users on monthly basis by mainly focusing on visual content, while other social networks such as Twitter had to compete with Facebook that has over 2.2 billion active users and already has publicly traded shares (FB).

While Facebook remains a solid competition to Pinterest as well, despite the differences in business models of the two companies, Pinterest is preparing to turn its potential and a solid rate of growth into more profitability with launching their IPO.

Pinterest has easily become one of the anticipated IPOs in 2019, this visually-focused social network has become heaven for advertisers and brands of all sorts, which could be turned into more profitability with the upcoming IPO.

Table of Contents

Pinterest Price Range Per Share for IPO

Pinterest is another one of the companies with a plan to go public, preparing their IPO for several years now, while the estimates for Pinterest IPO were set at 12 billion dollars back in 2017 when the company’s representatives stated that Pinterest is getting close to scoring 1 billion dollars n revenue generated through ads.

Even though the company was positive about the 12 billion dollars-worth IPO evaluation, estimates for the public offering for Pinterest have changed since 2017.

After reporting that Pinterest is close to making a billion through ad revenue, the company eventually reported 756 million dollars in revenue for 2018 when Pinterest officially filed for their IPO, that way lowering the initial estimates to 9 billion dollars.

Pinterest will issue 75 million A class shares, while they expect to see the share price set between the value of 15$ and 17$ per share, which should bring 1.3 billion dollars through the IPO sale in the best-case scenario.

The company has been officially approved for a listing on Nasdaq, where it should commence trading under the thicker (PINS).

Additionally, the company is said to be recording 60% of growth in revenue for 2018, however, Pinterest still have losses to cover, reporting 63 million dollars in net loss for the same period, year to year.

The company should become publicly traded under the thicker PINS by the end of spring 2019, when Pinterest will join the boom of tech IPOs.

What to Expect from the Upcoming Pinterest IPO in 2019?

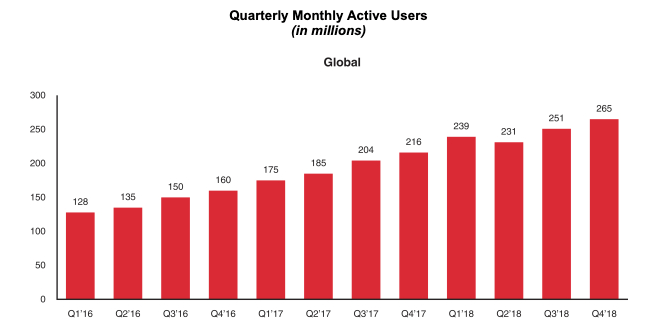

Pinterest reported 60% of growth in revenue for both 2016 and 2017, while the same reports showcased growth rate of 25% for userbase increases.

Back in 2016, when Pinterest had around 150 million users, the company was able to produce 300 million dollars in revenue, furthermore almost doubling their revenues in 2017 with 200 million users and 500 million dollars in profit.

Due to the fact that Pinterest managed to show an upward trend in both reporting increasing user base and the increasing rate of revenues, estimates provided the company’s IPO with evaluation at 12.3 billion dollars.

It is expected to have the IPO officially issued in April 2019 when the company will be able to showcase its potential as a publicly traded company.

In the meanwhile, Pinterest is working on different strategies that would help the company create stable sources of revenue for the upcoming period, while making partnerships with other brands such as Target.

Many analysts are comparing Pinterest IPO with Snapchat, which is why market watchers are ready to see around 60% of returns for early investors.

TechCrunch reported that, The San Francisco-based company, which will trade under the ticker symbol “PINS,” posted revenue of $755.9 million in the year ending December 31, 2018, up from $472.8 million in 2017. It has roughly doubled its monthly active user count since early 2016, hitting 265 million late last year. The company’s net loss, meanwhile, shrank to $62.9 million last year from $130 million in 2017.

Ask any Pinterest power user how much they love

Geoffrey Colon, Head of Microsoft Advertising Brand Studio wrote on Linkedin;

I always find it interesting when social media “strategists” when told of this Pinterest IPO news respond by saying, “There’s no value in a network like that, not enough scale.”

Forget scale for a second. Ask any Pinterest power user how much they love and learn from the platform and you have real users who spend quality time there learning things. Very unlike the platforms overtaken by bots and political turmoil.

Plus Pinterest has been at the forefront of the experience stack. In 2017 they introduced the possibility of shopping for things just by taking a photo of it. It was a combination of AI and photography at least a year before other platforms were throwing around the term. You simply tap the camera icon in the Pinterest app, snap a photo of something you dig — say, your friend’s cool dad sneakers — and it’ll be smart enough to churn out a list of pins with similar-looking sneakers.

This is a very interesting trending topic to watch.

Pinterest Files Confidentially for U.S. IPO

Pinterest Inc. has filed confidentially for a U.S. initial public offering and is expected to seek a valuation for the company of at least $12 billion, according to a person familiar with the matter.

The visual search site could list toward the end of June, said the person, who asked not to be identified because the details aren’t public. A final decision on the San Francisco-based company’s IPO plans hasn’t been made, the person said.

Pinterest, where users post and look for pictures that interest them, is working with Goldman Sachs Group Inc. and JPMorgan Chase & Co. to leawW2d its listing, which could raise about $1.5 billion, people with knowledge of the matter said last month.

The company raised $150 million in a private funding round in 2017 for a total valuation of about $12.3 billion. The confidential filing and potential timing were reported earlier by the Wall Street Journal.

Founded in 2010, Pinterest is among the longest-lived of Silicon Valley’s so-called unicorns — startups with a valuation of more than $1 billion — that are lining up to go public this year or soon after.

Pinterest’s losses are nowhere near like Uber and Lyft

According to NYtimes:

Lyft recently revealed that it lost $911.3 million last year.

Uber previously disclosed that it lost $842 million in the fourth quarter of 2018 alone.

PagerDuty, a software start-up valued at $1.3 billion that also filed to go public this week, said in its prospectus that it was losing money.

Only Zoom, a video conferencing company last valued at $1 billion, showed that it was making money, in an offering prospectus it filed on Friday.

Pinterest’s filing reported that the company had lost $63 million in 2018. But that was much narrower than a year earlier, when it lost $138 million.

Pinterest is growing quickly

Revenue totaled $756 million last year, up 60 percent from a year earlier.

It listed a cash stockpile of $628 million.

It had 265 million monthly active users in the fourth quarter of 2018, compared with 216 million in the fourth quarter of 2017.

Its number of users has grown steadily over the last two years, particularly as people outside the United States have begun to gravitate to its service.

The company’s global average revenue per user (ARPU) in the year ended December 31, 2018 was $3.14, up 25 percent YoY. Its U.S. ARPU, meanwhile, sat at $9.04, a 47 percent increase from the prior year.

ACCORDING TO THEVERGE, the company, although it is still not profitable, says it earned more than $750 million in revenue last year, and it’s cut its losses from nearly $200 million in 2016 down to just under $75 million annually. Pinterest says it was in fact profitable in the fourth quarter of 2018, but not profitable enough to get out of the red for the full calendar year.

Pinterest says its more than 250 million monthly active users have created more than 4 billion boards with a cumulative 175 billion pins saved. The platform itself has processed more than 2 billion searches.

It’s not clear at the moment how much money Pinterest intends to raise, making it difficult to get a handle on the company’s prospective market capitalization. Investors have put more than $1.5 billion into the company, with its last valuation putting Pinterest at around $12 billion. According to The New York Times, Pinterest’s largest shareholders, and those that stand to benefit most from an IPO, are Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity Investments, and Valiant Capital Management.