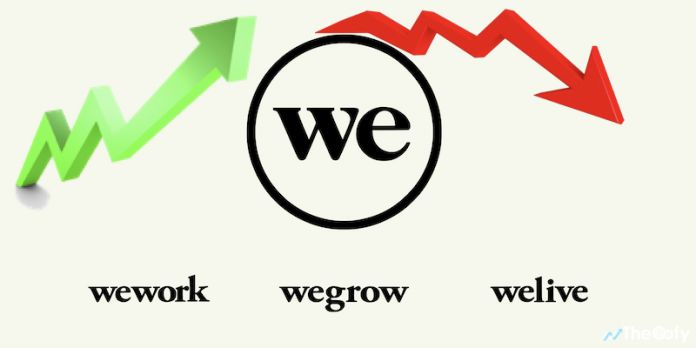

After showcasing an exceptional growth rate, the company divided its business models to three different branches now operating through WeWork, WeLive and WeGrow, which includes residential business, office space rentals and a coding academy, elementary school and gym.

WeWork posted an almost $2 billion loss for 2018, saying “heavy expansion costs” led to the surprising drop. Although revenue jumped to $1.82 billion, the co-working space company said “the losses are reflective of investments required to build out new offices,” according to The Wall Street Journal. The rate of occupancy at its offices also dropped in the third quarter of last year, which the company attributes to the speed at which it has expanded.

LinkedIn User Comments:

Table of Contents

What happens when a recession hits?

Sergio Puga MBA, PMP:

My only concern would be what happens when a recession hits? Can they sustain the cost of ownership of so many properties with much less occupancy? Strange that we have no had a recession in the U.S. since WeWork was created.

Joshua Lawton PMP, CSP, CSM:

Is losing $2B a drop in the bucket? Is it really a loss? Great questions for watchers and investors in WeWork.

Is co-working really the model of the future?

Stephen Simons, Chief Executive Officer at Restyn:

Is co-working and the gig economy really the model of the future? Or are more traditional companies still the greatest engine of economic prosperity the world has ever known?

Will WeWork succeed in becoming a profitable business?

Andrew Birks, Founder/CEO – Sirius Collaboration:

Really interesting article on WeWork. Clearly the growth in membership and revenues are impressive, but will it succeed in becoming a profitable and sustainable business?

When Will the We Company Go Public? Price Estimates, Profitability Rate, Funds, Date and More about the Upcoming WeWork IPO

WeWork, or the recently rebranded the We company, is another one of startups evaluated at billions of dollars through private funding rounds and due to exceptional growth rate, which made the company consider going public even back in 2018 when the startup IPOs were booming in the market, raising billions of dollars through initial public offerings.

After showcasing an exceptional growth rate, the company divided its business models to three different branches now operating through WeWork, WeLive and WeGrow, which includes residential business, office space rentals and a coding academy, elementary school and gym.

In the meanwhile, the company’s IPO is estimated at around 20 billion dollars, after one of their largest investors, SoftBank reduced their estimates for the company. Still, the company is planning on issuing its IPO in 2019.

What to Expect from the Upcoming WeWork IPO in 2019?

Initially proposing 12 billion dollars in funding for the tech startup unicorn, the Japanese-based SoftBank ultimately reduced their estimates to 2 billion dollars.

However, the CEO behind the We company claims that the reduced funding won’t affect their IPO as the company is said to have collected 2.5 billion in revenues during the course of a single year, with plenty of cash to work with.

The last funding the company had was around two months ago, while the company managed to raised over 13 billion dollars in total through private investors over the course of the last several years.

Besides from raising 10 billion dollars from SoftBank, the company was funded by more than several private investors, which includes JP Morgan & Chase, as well as Goldman Sachs, presently estimated at 20 billion dollars in comparison to the previous value of 47 billion dollars.

Even with the reduction on the side of the Japanese bank, WeWork appears to be in for a successful IPO round, once the company goes public.

For now, the exact date as well as the share price are yet to be revealed.