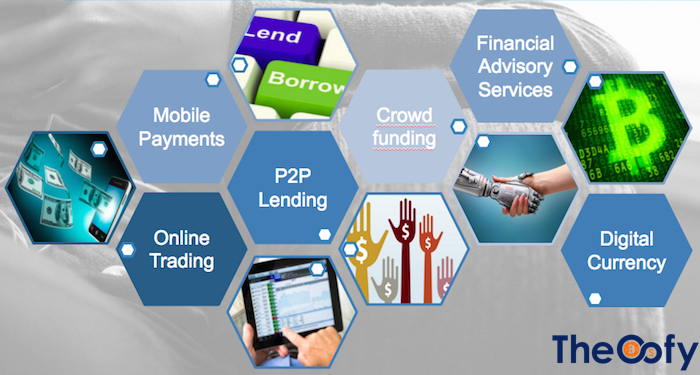

Five topics that highlight the way Fintech firms are changing the world: Fintech is clearly creating the in-roads into the traditional financial services market. It is poised to define the future of finance and thus serve as an inseparable link to the future landscape of the digital economy. However, one should not miss the following four topics that are frequently discussed related to Fintech Industry.

The Blockchain Technology

The blockchain technology is truly a revolutionary technology that is not only applicable to the world of finance but also to other areas of record keeping and data security. Five key concepts of the block chain technology are:

- Blockchain

- Decentralized databases applications

- Smart contracts

- Proof of work/stake.

- Trusted advanced computing

Digital Finance and Commerce & Digital Payments

The technology has impacted every aspect of human life. Financial sector was no different. Although highly regulated, the Fintech firms has already penetrated the customer base of the incumbents by offering services such as peer-to-peer transfers, savings, loans and credit products. Thus, advancements in technology has transformed the payment industry by offering rapid, safe and secure process of payments at lower costs.

Further, rise e-payments systems through various platforms are harbinger for the emergence of future digital banking.

Lending

Creation of lending models through the use of artificial intelligence, machine learning and big data has resulted in more effective credit decisions. In this way, the default rates of banks using such technologies are much lower than the traditional banks. Further, these credit models enable swift decision making and also served those customers that are largely ignored by the conventional banking.

Customer’s banking experience

Following factors are contributing to the shift of customers from traditional banks to the Fintech firms:

- Rise of millennial generation who prefer to use technology for their ease

- Frustration of customers towards the hidden fees taken by the traditional banks.

- Use of Big data to gauge the needs and behaviors of customers and create products to fill the gap left by the large institutions.

- Redefining the customer experience by providing round the clock digital banking.