In recent years, the discussions concerning banking technology have seen three key phrases, which topped the agenda including – APIs, DLT (Distributed Ledger Technology) and PSD2 (Payment Services Directive II). Even though DLT is in a mood to compete with other two concepts for media interest, yet the technology itself is passing through an evolutionary phase; hence, not cost-effective or powerful enough to be implemented within the conventional banking system.

On the other hand, APIs and PSD2 will manage to command the basic agenda of traditional banking in future. Increased competition and greater customer choice are two key objectives behind PSD2 and their achievement is linked with facilitated market access for monitored non-bank participants, increased customer protection, and transparency

When a Door Closes, another will Open

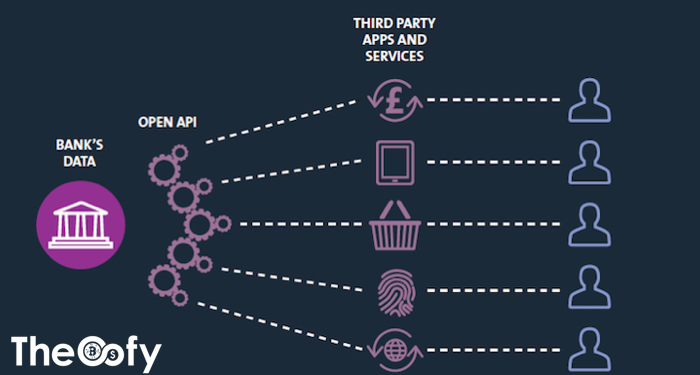

The most vigorously discussed element of the PSD2 regulation is the precondition to disclose client’s data to third parties. This advancement will introduce a flaring competition, yet on the other hand, it will provide huge possibilities for banks to capture customer ownership, find new revenue tributaries and advance towards a stretched out ecosystem.

Change is Inevitable

The traditional banking system is facing a huge challenge of replacing their inefficient and age-old infrastructure to streamline the essential banking operations. The open banking requires that each API is compatible with the fundamental architecture. In order to be compliant with this new technology, financial bodies must undergo a significant overhaul. One of the most cost-effective methods is to put an API controller between their conventional backend and the API World.

After the API is activated, the banks will have to make a choice as to whether they want to retain the business potentiality in-house or simply access the same via cloud whenever required. The real change that we are going to see in 2018 will relate to the banking sector’s approach to innovation.