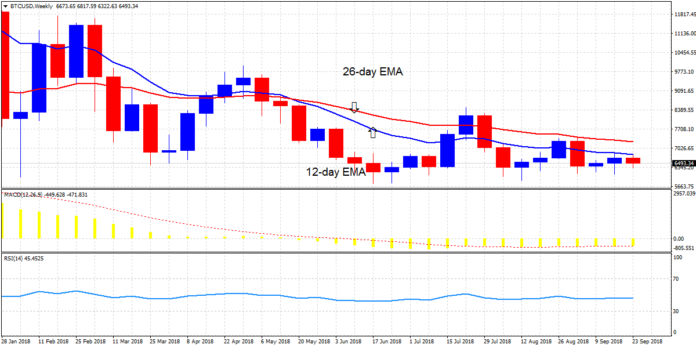

BTC/USD Long-term Trend: Bearish

⦁ Resistance Levels: $7,000, $7,200, $7,400

⦁ Support levels: $6,400, $6,200, $6,000

In September, the overall trend for Bitcoin’s price declines. The price of Bitcoin is $ 7,036.25 at the beginning of September 2018. The capital at the time of writing fell to $ 6,490.75. In other words, it lost 7.66% of digital money capital.

On September 5, the bulls remained at $ 7,400. The digital currency has fallen below $ 6,169.30. Since then, the bulls have not been able to compensate for their losses. For the bulls to be in balance with the bears, they need to break the 6, 500, 6.700 and $ 7.400 levels.

However, the MACD line and the signal line are below the zero line indicating a sales signal. Similarly, the price of Bitcoin is below the 12-day EMA and below the 26-day EMA indicating that the downward trend continues.

Meanwhile, the Relative Strength Index 14 period is at level 46, indicating that the price is within range.

Nowadays’ Common Prediction:

“Breaking above downtrend resistance is the next step”

⦁ BTC / USD spent a roller coaster week and peaked.

⦁ A collection of developments for crypto currencies was mostly positive.

⦁ Technical pic is developing, but Bitcoin needs to overcome its downward trend resistance. The survey of the experts shows a downward trend in the medium and long term.

Bitcoin’s price has made a bad start to the week, but things have increased rapidly. Bitcoin Cash was released from the first digital currency in 2017 and received support from Bitmain IPO in Hong Kong. Successful list of the company that holds the BCH, all the money sent higher.

JP Morgan, one of the largest banks, is moving towards blockchain technology. Quorom is based on Ethereum, is the consolidation period over? Many crypto suspects are now investing in cryptocurrencies.

Need the Exchange Traded Fund to attract main investors. SEC is not in a hurry to make a decision as soon as possible, but no matter what time, movements can be great.

Another positive development came from Google. The technology giant, which previously banned crypto ads, is now taking baby steps to allow such ads in the US and Japan. Competitors will go through a long process, but this may be the first step in wider acceptance.

Table of Contents

BTC/USD Technical Analysis

BTC / USD is currently trading above the 50-day Simple Moving Average, a positive sign, the key to the $ 6,800 level. The level closed earlier in early September and is also where the downward trend in July met the price when writing. Higher fracture is very important for further movement.

Momentum gave positive results for Bitcoin, but the Relative Strength Index is not always fast. The 200-day SMA is at $ 7.400, a high-resistance line. Between $ 6,800 and $ 7,400 we find the round number of $ 7,000. Only above, $ 7,150 at the end of August BTC / USD and $ 7,200 in support of high ground provided support.

In mid-September, $ 6,600 was a line of resistance and served as support. Further down, there was an earlier decline of $ 6,300 per week. $ 6,200 was supported in mid-August, and $ 6,550 dropped the flash of the moon earlier.

Cost of Bitcoin has not possessed the capacity to achieve the highs of $7.400 and $ 8,000 in light of its lack of power to break the $6,700 value level. More purchasers are required at this level to drive cost through. Today, the BTC cost is exchanging at $6,619.31 as at the season of composing.

BTC/USD Short-term Trend: Ranging

On the 1-hour chart, the price of BTC is flat. The price of BTC is dropping and approaching the $ 6,600 price level. The price tends to rise. The price is above the EMA of 12 days and the 26-day EMA showing that the price has risen.

BTC/USD Medium-term

⦁ Resistance Levels: $ 7,000, $ 7,200, $ 7,400

⦁ Support levels: $ 6,400, $ 6,200, $ 6,000

Last week, Bitcoin’s price was intermittent. The crypto currency doubled and resisted the price level of $ 6,700. The Bitcoin price did not reach the high levels of $ 7,400 and $ 8,000, since it did not break the $ 6,700 price level.

Up to this level, more buyers are needed to increase the price. Today, the price of BTC is traded at $ 6,619,31, like the one written.

Then, the MACD line and the flag line are over the zero line which demonstrates a purchase flag. The cost of Bitcoin is over the 12-day EMA and the 26-day EMA which shows that cost is in the bullish pattern. The Relative Strength Index period 14 is level 55 which demonstrates that cost is in the sideways pattern zone.