Tom Lee, Managing Partner of Fundstrat Global Advisors, recently held a survey on Twitter to measure public awareness on the crypto market. The survey gave important clues about the crypto market.

Tom Lee published a survey on Twitter to learn how people are approaching the crypto-money market. Fundstrat Global Advisors, which took its place in the market in 2014, became the most mentioned company in the name of crypto money research. Currently, he is the Managing Partner and Head of Research at Fundstrat.

Previously, we had stated that Tom Lee had been insisting on staying in the BTC for a while. Although Bitcoin is currently traded at $ 6,550, Tom believes that Bitcoin in Q4 could rise to $ 25,000. A large majority of respondents also think the bear market is over in the crypto-money sector.

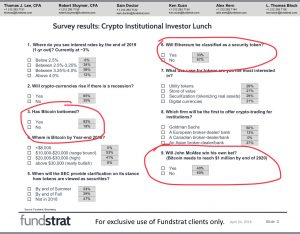

Fundstrat Survey: 54% of Institutional Players Think Bitcoin Price Has Already Bottomed

Lee asked sixty questions to his 57,000 Twitter followers. All of the questions give important information about what the market is thinking. Each question was answered by five to six thousand people. According to this survey, 45% of the participants think that BTC has seen the bottom level. 43% of them think that the next year’s best performance will be the krypton XRP.

Survey Results As follows;

Question 1: What do you think is the most important factor affecting crypto prices?

Central banks – 35%

Emerging markets – 27%

USD – 18%

Geopolitical tension – 2%

Question 2: Do you think that crypto prices have risen in economic recession?

Yes – 59%

No – 41%

Question 3: When do you think Bitcoin will see the dip level?

Before 2018 – 25%

Until March 2019 – 18%

After half of 2019 – 12%

Bitcoin already on the bottom – 45%

Question 4: What are your Bitcoin 2019 year-end forecasts?

Under $ 6,999 – 12%

Between 7,000 and 10,000 $ – 20%

$ 10,000 with $ 15,000 – 25%

$ 15,000 and up – 43%

Question 5: Which of the following tokens do you think will perform best next year?

Bitcoin – 33%

Ether – 16%

EOS – 8%

XRP – 43%

Question 6: Which of these tokens means the least to you?

Bitcoin – 18%

XRP – 30%

TRON – 33%

Others – 19%

Table of Contents

According to the results of the survey

From the answers, we can say that 45% of the respondents think that BTC is at the bottom of the level. Although BTC is currently about $ 800 more than the lowest ($ 5,743) seen this year, most traders believe it is at the bottom. As many analysts say, if BTC’s falls to $ 3,000, they may experience a serious disappointment. However, close to 90% of the participants are hopeful of 2019 Bitcoin prices. The crypto sector generally thinks the bear market is over.

XRP 2019’s Most Promising Crypto

For many analysts, it may be a surprise that the XRP has been so heavily supported, that even though the XRP has seen an increase of over 100% in the last few weeks, 43% of the participants think that the XRP will continue its upward trend. And next year, the survey will be the best performing crypto currency in the four options.

How are Crypto Coins Affected by the Economic Crisis?

Another important result is that 59% of respondents think crypto coins rise in economic recession. I can’t say anything about it yet. Since Bitcoin was launched in 2009, there has never been a big global recession. There is not enough data to say whether Bitcoin will rise during the economic crisis.

Many Bitcoin fans see Bitcoin as a kind of Digital Gold. If we think about Bitcoin in this way, then we can look at how Bitcoin is performing during the economic recession. In 2008, gold fell by 30%.

Some analysts believe that in economic recession, investors are converting assets such as gold into cash to ensure their portfolios. Therefore, he believes that assets are losing value in this process. This may mean that Bitcoin will share the same fate as gold after the next global economic crisis.