Slack is reporting around 10 million active users on daily basis, while the company managed to collect 427 million dollars in a private funding round back in August 2018, also collecting 250 million dollars in 2017 from private investors.

You can buy Slack on trader platforms like Robinhood when it goes public.

Table of Contents

Everything You Need to Know About Slack IPO

Slack, a popular workspace messaging application, is joining the growing market of startup IPOs that turned out to be a huge success during the last year. Based on the number of startup IPOs waiting to be issued in 2019, this might be another great period for initial public offerings as around 300 billion dollars in estimated value should enter the market and go public.

Slack value for IPO is set at 7.1 billion dollars

Furthermore, Slack appears to be planning to go for direct listing without going through a round of funding first as private investors already made estimates for the company stating that its value for IPO s set at 7.1 billion dollars, also adding that there should be an increased demand for Slack shares once the company goes public.

What to Expect from the Upcoming Slack IPO in 2019?

After having the sector of private investors evaluating the company’s shares at 7.1 billion dollars, however, multiple private firms are lining up for the upcoming Slack IPO, estimating the value of shares at 13.1 billion dollars.

Slack hired Goldman Sachs to lead their IPO

Slack representatives have already hired Goldman Sachs to lead their IPO, while it is expected to see the IPO going live in 2019 as the company filed their filings to SEC back in February as announced by the company back on February 4th in their official blog post.

Slack is reporting around 10 million active users on daily basis, while the company managed to collect 427 million dollars in a private funding round back in August 2018, also collecting 250 million dollars in 2017 from private investors.

Slack already raised 1 billion dollars

The company is said t have already raised 1 billion dollars thanks to private investors such as General Atlantic, SoftBank Vision Fund, T. Rowe Price Associates, and Dragoneer Investment Group.

The exact date of the IPO issuance is yet to be revealed, while the estimated price per share also remains unknown for now as the company is preparing to go public.

Slack Valuation: $7.1 billion, 8 million daily active users

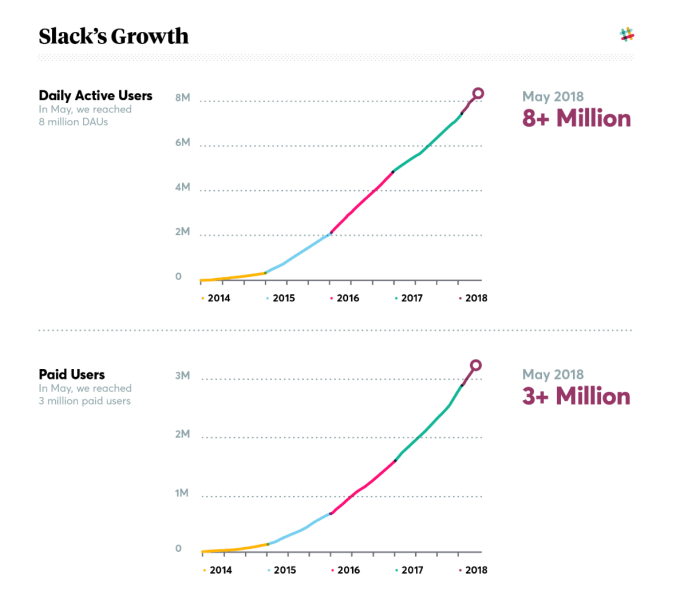

According to Quartz, Slack to go public in one of the first major IPOs of 2019. Since its founding 10 years ago, Slack has become a Silicon Valley powerhouse valued at $7.1 billion, according to private equity research firm PitchBook. Last year, it said it had 8 million daily active users and 3 million paid users.

Slack’s growth numbers as of May 2018

Slack intends to pursue a direct listing rather than traditional

Last month, the Wall Street Journal reported Slack intends to pursue a direct listing, rather than list through the traditional process of selling shares at a set price and securing investors in advance. Instead, shareholders (rather than the company) can sell their shares directly in the public offering. If Slack chooses this path, it will follow in the footsteps of Spotify’s successful direct listing last year. The move allowed the company to avoid steep fees from investment banks, and lockup periods for insider shareholders. Direct listings make sense for companies that don’t need to raise funds, but want to give employees and early investors the opportunity to cash out.

Slack emerged from the ruins of a failed game company called Tiny Speck

Founded in 2009, Slack emerged from the ruins of a failed game company called Tiny Speck, which shut down in 2012. Tiny Speck’s team was dissatisfied with the communication tools available at the time and built what ultimately became Slack along the way. Its whimsical aesthetic and developer-friendly design made it an instant hint with software startups, newsrooms, and soon many others. Early adopters spread the gospel to small and mediums businesses, and then Slack took a shot at the enterprise space. The company has grown from 22 people in 2011 to more than 1,000 today.

Slack is now the dominant workplace communication and collaboration tool

Slack is now the dominant workplace communication and collaboration tool. Over the last five years, it managed to eclipse almost every major competitor in the space. One of the largest, Atlassian, offered HipChat and later Stride. But Atlassian announced it is retiring both products by this month. and leaving the communication business entirely in favor of project management. A “partnership” Atlassian struck with Slack last year sent its former rival the IP behind HipChat and Stride, and migrated its customers over to Slack, which also got a small equity investment from Atlassian in the deal. That leaves Microsoft’s Teams. In 2016, Microsoft tried to acquire Slack for $8 billion, and failed. Microsoft said last March that Teams is used by 200,000 organizations, up from 50,000 when it launched in 2017.

Slack can swoop before the IPO

According to TechCrunch, Slack can swoop before the IPO if tech giants knock the door. Earlier this week, Slack announced that it has filed the paperwork to go public at some point later this year. The big question is, will the company exit into the public markets as expected, or will one of the technology giants swoop in at the last minute with buckets of cash and take them off the market?

Slack is Competing with Microsoft, Cisco, Facebook, Google and Salesforce

Slack, which raised more than $1 billion on an other-worldly $7 billion valuation, is an interesting property. It has managed to grow and be successful while competing with some of the world’s largest tech companies — Microsoft, Cisco, Facebook, Google and Salesforce. Not coincidentally, these deep-pocketed companies could be the ones that come knock, knock, knocking at Slack’s door.

Slack has managed to hold its own against these giants by doing something in this space that hadn’t been done effectively before. It made it easy to plug in other services, effectively making Slack a work hub where you could spend your day because your work could get pushed to you there from other enterprise apps.

Is there any reason for Microsoft not to buy Slack for $20 billion? Seems like a perfect fit and at $20 billion could be a bargain.

— Jay Yarow (@jyarow) February 6, 2019

Tech vs Healthcare IPOs

According to Business Insider, healthcare has dominated the US IPO slate this year.

The initial-public-offering market suffered through a slow start to the year because of the partial government shutdown and the brutal fourth quarter for financial markets, but public debuts are ratcheting back up.

While a host of high-profile unicorns and decacorns like Lyft, Uber, Airbnb, and Slack are set to debut on the public market this year, so far healthcare has dominated the US IPO slate.

It’s still early to compare this year’s performance to prior years’, but so far healthcare is the most active sector to debut on US exchanges in 2019, according to Renaissance Capital.

The group’s showing in the first quarter suggests a strong year ahead for biotech and healthcare, some analysts say.

Is direct listing an issue for investors?

According to Bankrate, FEBRUARY 13, 2019, it might be riskier than traditional methods. Slack is bypassing the usual method of going public – an initial public offering (IPO) – in favor of a direct listing. In an IPO, a company hires an investment bank to sell stock to the public. Typically the company raises capital for itself, and some insiders cash out a portion of their stock.

However, in a direct listing, the company’s shareholders, such as early investors or employees, just begin selling their stock on the exchange, cutting out the Wall Street banks. Public investors buy stock directly from these insiders at first. And that’s what Slack is doing. It’s not looking to raise money for itself, and it’s only these insiders who are initially selling stock.

The direct listing route is rare

The direct listing route is rare. Usually it’s been used for smaller, less-publicized companies, but Swedish music streaming company Spotify – then valued at about $20 billion – used the method in early 2018. Slack’s valuation is estimated at $7 billion, and it’s one of the more anticipated market debuts in a while. The company reported that it had more than 10 million daily active users in 150 countries.

Projected sales of $389 million

Slack has projected sales of $389 million for the year ending January, good for growth of 76 percent year over year. It’s projecting sales growth of 64 percent this year, when it should generate free cash flow, management says. Those are heady figures, but the valuation looks pricey at more than 11 times sales. But if it sales growth can remain high, it may not look so expensive for long.

Spotify’s direct listing came off without any major issues

While investors need to examine the risks associated with Slack’s listing – as they would for any stock – this debut poses special areas of risk that investors don’t typically encounter. That said, Spotify’s direct listing last year came off without any major issues, so a direct listing can work.

One of the most anticipated stocks of 2019

Slack may well turn out to be a great investment. It’s certainly one of the most anticipated stocks of 2019, which may include even more darlings such as ride apps Uber and Lyft and home-sharing app Airbnb. But investors looking to buy them will need a sensible long-term strategy and will want to understand how to invest smartly before plunging in. Regardless of how great Slack or any company looks, savvy investors diversify their holdings, so they’re not exposed to too much risk in any one investment.