The CEO behind the We Company claims that the reduced funding won’t affect their IPO as the company is said to have collected 2.5 billion in revenues during the course of a single year, with plenty of cash to work with.

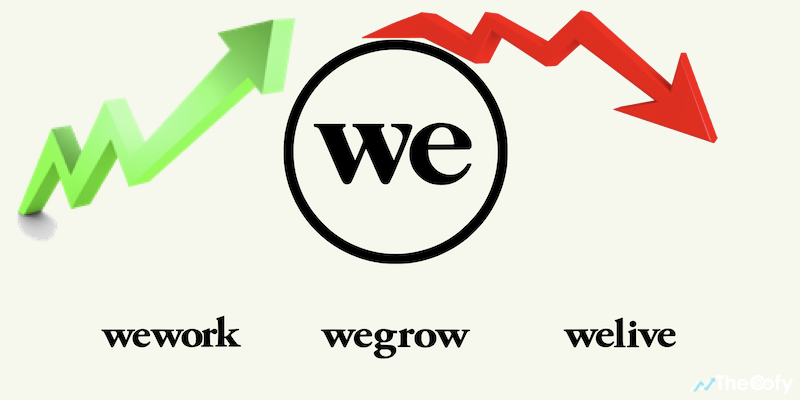

After showcasing an exceptional growth rate, the company divided its business models to three different branches now operating through WeWork, WeLive and WeGrow, which includes residential business, office space rentals and a coding academy, elementary school and gym.

Table of Contents

Experts Skeptical About Valuation: Burns A Lot Of Cash, But Growing Rapidly

WeWork reportedly files an IPO in 2019. But After Softbank pulling back of an investment from $16B, company valuation has drastically dropped.

WeWork IPO Date 2019: When Will the We Company Go Public? Price Estimates, Profitability Rate, Funds, Date and More about the Upcoming WeWork IPO

WeWork, or the recently rebranded the We company, is another one of startups evaluated at billions of dollars through private funding rounds and due to exceptional growth rate, which made the company consider going public even back in 2018 when the startup IPOs were booming in the market, raising billions of dollars through initial public offerings.

In the meanwhile, the company’s IPO is estimated at around 20 billion dollars, after one of their largest investors, SoftBank reduced their estimates for the company. Still, the company is planning on issuing its IPO in 2019.

What to Expect from the Upcoming WeWork IPO in 2019?

Initially proposing 12 billion dollars in funding for the tech startup unicorn, the Japanese-based SoftBank ultimately reduced their estimates to 2 billion dollars.

However, the CEO behind the We company claims that the reduced funding won’t affect their IPO as the company is said to have collected 2.5 billion in revenues during the course of a single year, with plenty of cash to work with.

The last funding the company had was around two months ago, while the company managed to raise over 13 billion dollars in total through private investors over the course of the last several years.

Besides from raising 10 billion dollars from SoftBank, the company was funded by more than several private investors, which includes JP Morgan & Chase, as well as Goldman Sachs, presently estimated at 20 billion dollars in comparison to the previous value of 47 billion dollars.

Even with the reduction on the side of the Japanese bank, WeWork appears to be in for a successful IPO round, once the company goes public.

For now, the exact date, as well as the share price, are yet to be revealed.

SoftBank’s $2 billion investment, which was much lower than its initial $16 billion

We Company, the new parent company of WeWork, is reportedly considering an IPO. If We Company issues an IPO, it will “have to justify its new $47 billion valuation”

The move comes amid SoftBank’s new $2 billion investment, which was much lower than its initial $16 billion

Experts have been skeptical about its valuation

The news of an upcoming IPO now comes shortly after SoftBank Group slashed its investment in WeWork from $16 billion to $2 billion. If We Company issues an IPO, it will “have to justify its new $47 billion valuation”. The coworking giant might have a hard time doing that, especially considering experts have been skeptical about its valuation for years now and, most recently, even key investors from SoftBank are doubting the company’s potential and long-term success.

WeWork’s bond trading value has dropped significantly

According to allwork.space, furthermore, WeWork’s bond trading value has dropped significantly since it issued $702 million in “junk” bonds. It is currently trading at 86 cents on the dollar. The ten-year old company is yet to be profitable and just last year it quadrupled its losses to $1.2 billion.

Furthermore, WeWork’s bond trading value has dropped significantly since it issued $702 million in “junk” bonds. It is currently trading at 86 cents on the dollar. The ten-year old company is yet to be profitable and just last year it quadrupled its losses to $1.2 billion.

$2 billion Revenue

According to Mothley Fool, WeWork, which was most recently valued at $45 billion sometime in the past and counts Softbank as its largest investor. Though many investors are perplexed by WeWork’s valuation, believing that the company is just repurposing office space in a way that any other competitor could, the company has grown like a weed, with more than 500 locations in 96 cities around the world. After the company sold $3 billion in additional shares to Softbank in November, an IPO next year seemed less likely — WeWork is well funded at the moment. But if market conditions are amenable, WeWork could debut in 2019.

WeWork losses continue to widen

WeWork’s revenue is set to approach to $2 billion this year and is still growing fast — revenue more than doubled in the second quarter. The company has more than 500,000 members, but its losses continue to widen as it invests in growth, and that could be a concern for investors.

$2.5 billion in revenue and plenty of cash

CNBC reported that, WeWork CEO Neumann says the company hit $2.5 billion in annualized revenue and has plenty of cash.

WeWork CEO Adam Neumann says SoftBank’s reduced investment won’t hinder the company’s growth. Neumann says he has a “beautiful” relationship with SoftBank CEO Masayoshi Son. WeWork CEO Adam Neumann said his company reached annualized revenue of $2.5 billion in the fourth quarter and has plenty of cash on its books, even with SoftBank’s scaled-back investment.

Neumann’s not concerned that SoftBank pulled way back

Neumann told CNBC that he’s not concerned that SoftBank pulled way back after initially agreeing to invest $16 billion in the company, which provides coworking office space and is busy expanding into other areas. And he still has plenty of praise for SoftBank CEO Masayoshi Son, whose presence in the venture capital landscape has ballooned over the last few years with the $100 billion Vision Fund.

Wework raised a total of $10 billion from SoftBank

“There’s something beautiful about Masa and my relationship,” said Neumann. WeWork has now raised a total of $10 billion from SoftBank, including the first $3 billion after a short meeting between Neumann and Masa. Neumann said that when negotiations get tough, they approach each other as partners, explain each other’s limitations and, “thread the needle in between.”

Burns a lot of cash, but growing rapidly

Most of SoftBank’s recent investment is at a post-money valuation of $47 billion, but $1 billion of the investment was at a lower, pre-money valuation of $20 billion.

The company burns a lot of cash, but it’s also growing rapidly, more than doubling memberships in 2018 to 372,000, according to preliminary year-end numbers shown to CNBC. The run rate of $2.5 billion is up from $2 billion the prior quarter.