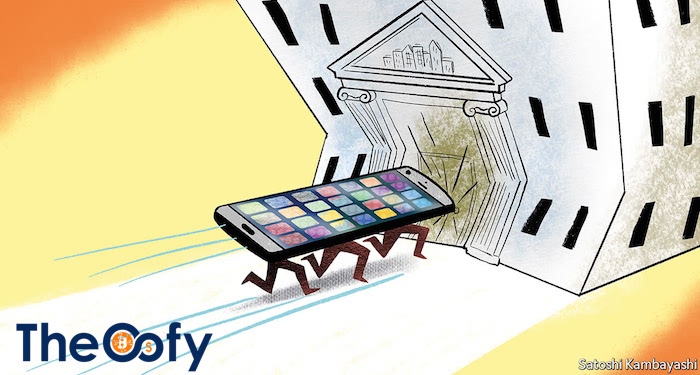

Fintech industry Highlights: Fintech as an innovation is driving the future of financial industry. It emerged as a missing link between the conventional financial services and a future world of finance. However, it is pertinent to delve into history in order to understand the emergence of these financial and technological wizards.

It all started with the financial crisis of 2008 when the big banks were restricted through stringent regulations such as criteria to lend loans. These hard times also witnessed unprecedented rise in technology that effectively exploited the presented opportunity. Concomitantly, the demand for flexibility, convenience and a streamlined user experience in the financial services sector favored the Fintech firms.

Further, these financial innovators introduced following innovations:

- Cryptocurrency platforms such as Bitcoin

- Blockchain technology used to execute intelligent buyer-seller contracts.

- InsurTech

- Banking 24/7

- Investment advice provided by the Robo-advisors.

- Data and funds security through innovations in cyber security.

- Increased financial inclusion.

As the conventional banking activities were restricted, the Fintech firms such as Contis started to provide the changing customers with banking and payment services. This is important because these firm’s should be credited as they provided the financial services to low-credit customers. The customers which the traditional banks ignore.

According to EY Fintech adoption index, top five countries according to adoption are:

- China (69%)

- India (52%)

- UK (42%)

- Brazil (40%)

- Australia (37%)

Further the report also highlights the most used services of Fintech firms and these are:

- Money transfer and payments (50%)

- Insurance (24%)

- Savings and investments (20%)

- Borrowing (10%)

- Financial planning (10%)

The above are the percentage of digitally active customers who have used each product.

The Fintech firms are rapidly transforming the banking sector of the world. Citibank estimates that the structural change could reduce the banking jobs by at least 30%. However, it is also reported that there will be a creation of new jobs as well.

Illustration Source: The Economist