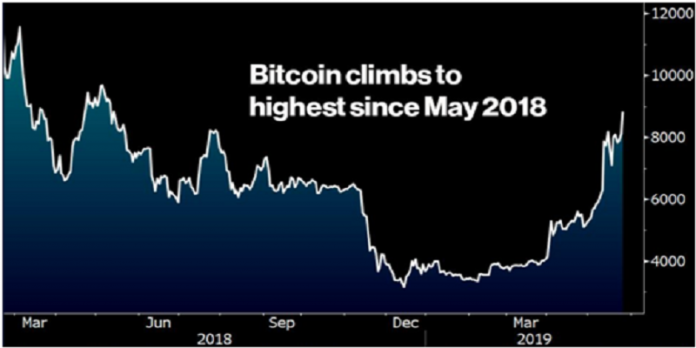

BTC declined below $8,000 within days of testing the $9,000 mark, which shows that A lot of professional traders who rode the parabolic rally cashed out near the $9,000 mark. Bitcoin’s ongoing corrective bounce could be short-term, as the charts are signaling a short-term bullish-to-bearish trend change. We are likely to see a lot of sideways movement before the next big move. The trend line support of the ascending wedge will not serve as resistance and is likely to stop the next bullish advance.

Table of Contents

Top Exchanges are Launching Margin Trading

BTC failed to stabilize above $9,000 was unable to re-enter a triangle chart formation, essentially confirming that the bullish run was indeed over. And a lot of consecutive consolidation and correction will form the next coming trend, which means there will be many price fluctuations in BTC market.

Based on the recent and coming trend, early crypto exchanges are hoping to stay ahead of the pack is by adding margin trading options when most investors using the platform have been restricted to spot buying and selling of cryptocurrencies. Coinbase is about to add margin trading pairs, while Binance launched the max 2x leverage futures trading. Crypto investors show much disappointment in Binance’s low leverage, and prefer the 100x leverage offered by BitMEX, Bexplus and Deribit.

Margin Trading Benefits

The main advantage of margin trading is that you can leverage a regular position without having to hold the required traded cryptocurrency amount. In addition, it allows you to open trading positions in both ways – long (betting on price up) or short (betting on price down).

To store a great amount of cryptocurrencies on an exchange is generally not recommended. Another advantage of crypto margin trading is that, by using leverage, you can trade large positions with small amount of cryptocurrency deposited in an exchange and hedge your portfolio during a bear market in particular.

How to Trade Margin Trading with 100x Leverage

Founded in late 2017, Bexplus is a Bitcoin-based 100x leverage crypto exchange with no spread. It serves traders worldwide – in just over 36 countries, providing them with proper liquidity, a variety of trading tools and features, while also maintaining security and a safe trading environment.

1) Open short position

If you predict the market is going down and you invest in 1 BTC to trade 100 BTC futures contracts with 100x leverage at the position 1 ($8,000), then, you close the position at the position 2 ($7,500).

Your profits: 100 BTC (8000-7500)/8000 = 6.25 BTC

2) Open long position

Assuming the market is rising and you open 100 BTC positions at the position 2 ($7,500), then close the position at the position 3 ($7,800).

Your profits: 100 BTC (7800-7500)/7800 = 3.84 BTC

As you can see, with USD 300 – 500 price fluctuations, you can earn up to 3-6 BTC with 100x leverage added. If you want to trade BTC margin trading now, you can try in Bexplus with 10 free BTC preset. And you will win 100% BTC bonus after depositing in Bexplus.

Joining Bexplus’s Gift June activity, you will have a chance to win presents including, Apple watch, iPad, Kindle, etc. Not only can you make profits on BTC futures trading, but also get wonderful gifts.

More: https://www.bexplus.com/activity/gift_june