What is the hardest part is the market timing when trying to forecast cryptocurrencies. You definitely need to make a fortune in the markets, which is technically impossible.

Please take my apologies in advance for my market timing prediction below.

Bitcoin is definitely going to move. Although its direction is of utmost importance but the timing seems to be the real deal.

Please enter CoinGecko Free Api Key to get this plugin works.The idea does not appear well intuitive; however, you need to know the direction to jump on when something seems to get somehow re-priced. There are good and bad times for markets, and this is a juncture for Bitcoin.

Table of Contents

Co-Founder of Zebpay keeps “Bullish on Bitcoin” against the exchange closure

Recently, Sandeep Goenka shut off his Indian Bitcoin exchange; however, he keeps being optimistic to the digital currency as the beginning of financial decentralization.

Zebpay’s co-founder, which is now disused, tweeted that he is more bullish on Bitcoin than always. Goenka is not alone among entrepreneurs or investors expressing an optimistic view to the digital currency. However, this statement seems to occur when Zebpay is criticized for its former users drawing back their exchange services without even a warning.

U and ur company betrayed us by charging so high fees and giving us so less time…thanks for showing ur real face to our indian crypto community…ur company deserved to be closed like this only

— cryptovenom (@mayank03541396) October 2, 2018

Zebpay announced its leave on September 28, as they get a dismissal from the Ministry of Finance, the Reserve Bank of India (RBI), the Income Tax Office, and the Directorate of Enforcement.

Indian exchanges were in a court fight with the central bank when they get exposed to their banking ban circular. On the other hand, the Indian apex court always delays the case to first wrap-up previous backlogs. Meanwhile, the local exchanges’ loss is getting bigger and bigger.

We are stopping our exchange. At 4 PM today, we will cancel unexecuted orders & credit your coins to your Zebpay wallet. No new orders will be accepted. The Zebpay wallet will work even after the exchange stops.

Read more: https://t.co/W8ygzPIYz1 pic.twitter.com/tPWCnyu7Yu

— zebpay (@zebpay) September 28, 2018

In their announcement, Zebpay clearly stated: “The curb on bank accounts has crippled our, and our customer’s, ability to transact business meaningfully. At this point, we are unable to find a reasonable way to conduct the cryptocurrency exchange business.”

After the announcement, the exchange let its users to draw their existing crypto-to-crypto orders back during the day. The users are, of course, a bit concerned, accusing Zebpay for not giving enough time for their long/short positions. Nonetheless, Zebpay assured their customers for its function as a wallet service regardless of what the Indian regulators do.

In other saying, the market will be ready for another valuation “wild goose chase” upon the agreement on the price and regulations. A new era is imminent.

Zebpay, safe or not?

Goenka’s tweet reveals that there is an effort to find a balance between the crypto community and regulators.

Zebpay’s co-founder highlights also the need for regulating cryptocurrencies, but never had control over the government dissimilar to many others in the Indian Bitcoin community. He supported the regulations and identified Zebpay as to comply with every AML/KYC regulation, even when Bitcoin exchanges did not ask for being compliant.

In February, he stated: “Every citizen and business in this country should play their role in eliminating financing of illegitimate activities, regardless of whether such financing is done using legal tender, cryptocurrency, gold or any other medium […] We encourage the government to work with our members, as we are committed to detect, report, and eliminate suspicious transactions in pretty much the same way as other institutions do.”

But the exchange could not avoid submitting before the RBI circular, which in turn prevented its ability to convert crypto from/to fiat. Some other Indian exchanges rather preferred to go for P2P.

Zebpay could wait, but instead stopped its trading services to hold their position in front of the regulators. Evidently, the wallet services are not capable to get re-launched as exchanges. However, apparently, it attempts to avoid regulators with some sort of a break.

Chart

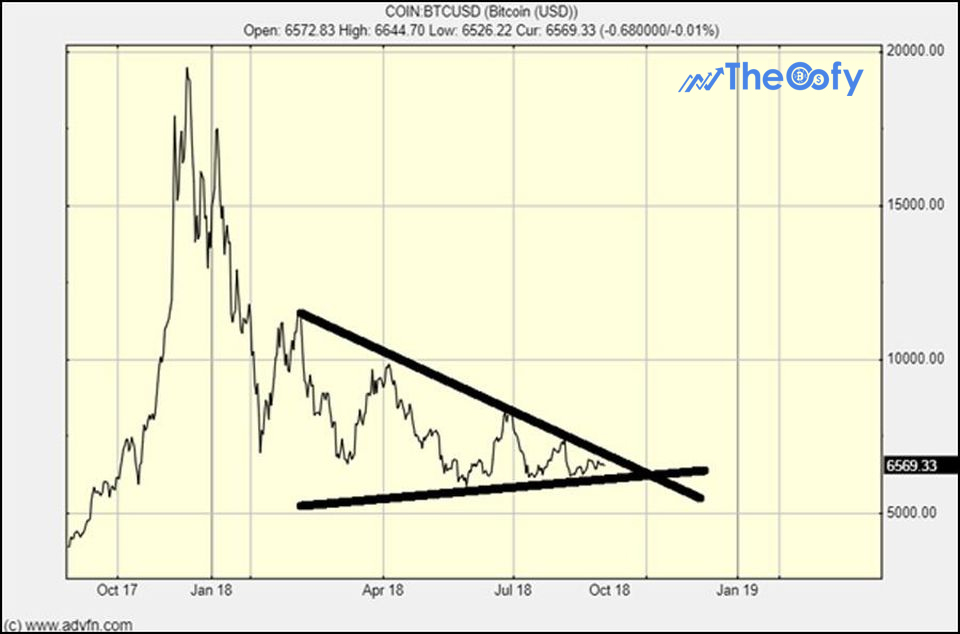

No chart would be complete without some pseudo-science, so what you see above is the end of a reprice series where the market has struggled to agree on a price for bitcoin. This has resulted in a series of rallies and dips that have developed into a tightening range. Once the range has shrunk to nearly nothing the price of the asset enters a new phase of discovery.

At the moment, the chart makes us think that we are going to leave the aftermath of the Bitcoin and enter in a new era.

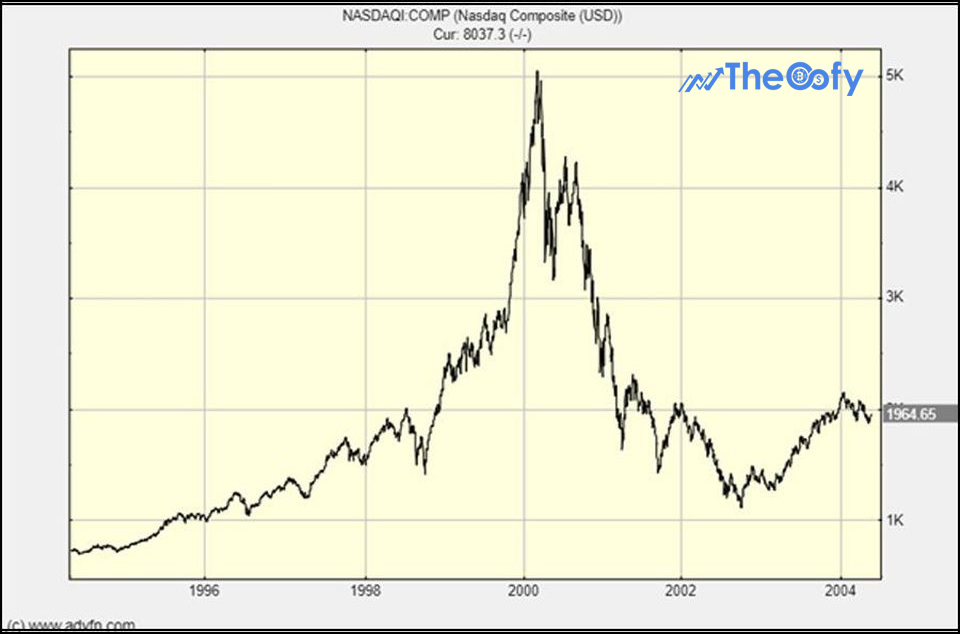

The bitcoin chart seems somehow familiar. The market history of booms and busts is loaded with analogue charts.

A suitable example would be the Nasdaq. Dotcom bubble:

Large amounts of money are out with the bubble and back at the bottom. In this regard, while investing, the market bottom is always of utmost importance to watch. The successful investors opt for this pattern instead of picking tops. Peaks can be highly difficult to handle and are somehow dreamy, which can get lost in just moments. We actually have time for considering Bitcoin under current circumstances.

However, Bitcoin can plummet as well from this very point. It would be actually better for me as I’m waiting for more affordable coins. No one is obliged to make transactions.

According to the chart, this post-crash series is about to last in no time.

Although Bitcoin may up- and downsurge as well, it does not appear so much probable.

$6,000 has been a clearly bold bottom for Bitcoin, showing a resistance not to be readily lost. The most significant risk for Bitcoin is its possibility to drop to $0, instead of $2,500; the actual risk is its being an imaginary asset by the end of the day. If you do not agree as I am, so Bitcoin is remarkably cheap.

According to the chart, Bitcoin is up for a new era. This might be the final capitulation; however, my perception is clouded as I want this result. So, there are going to occur many opportunities over extensive movements.