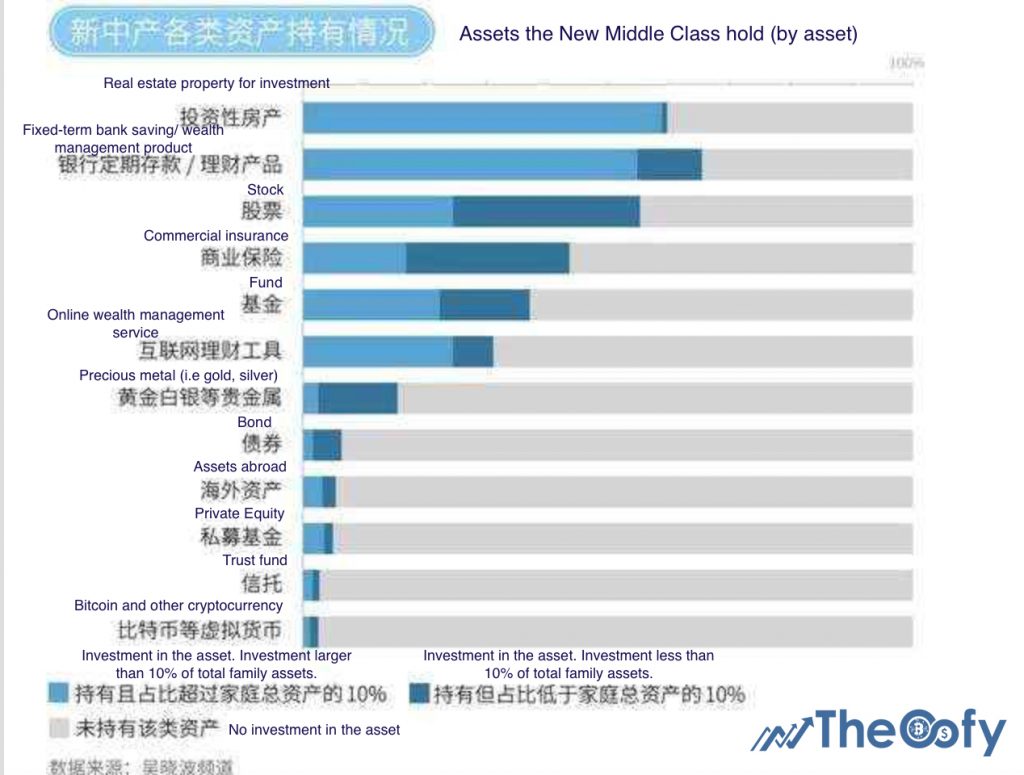

After the government ban, according to a recent study declared by Technode Thursday, September 26 less than 10 percent of the Chinese middle class people are investing in cryptocurrencies.

The report called “2018 White Paper on the New Middle Class” was organized by Chinese financial writer and Professor of Shanghai Zhejiang University Wu Xiaobo. Wu decoded the investment conducts of members of the Chinese middle class in the study. The newest version marks the first time Bitcoin (BTC) or cryptocurrencies have seemed in the annual report.

To get adequate data for the report, Wu and his team held a review of 100,000 individuals and collected 1 million pieces of data from other cradles. Digital currency is the least fashionable asset in the respondents’ investment portfolios — an projected figure given rigorous anti-crypto measures from Beijing, according to the study.

As per Wu, the country’s middle class is risk- opposed as only 9.2 percent of respondents demanded they would accept losses higher than 15 percent. Therefore, they are improbable to invest in Bitcoin and cryptocurrencies due to their high instability.

The Chinese government has begun a campaign against crypto-related happenings in 2017. Regulators closed all of the country’s cryptocurrency exchanges in addition to banning Initial Coin Offerings (ICOs) in September 2017. The country’s central bank, the People’s Bank of China, has frequently presaged citizens about the risks of crypto trading.

Beijing forbidden crypto-related advancements in the capital area, later extending the ban to the Guangzhou Development District in August 2018.

In an effort to comply with the new rules, Chinese messenger WeChat blocked a number of noteworthy crypto media accounts, whereas tech giant Baidu closed at least two popular crypto-related forums. Local e-commerce giant Ali Baba promised it would restrict or permanently ban any accounts intricate in crypto trading.