According to Diar’s research, many ICOs still have a lot of Ether in their brains. According to Diar’s research, many ICOs still have a lot of Ether in their brains. Ethereum, which is at a price level of $ 192, unfortunately declined by 86% at the peak of $ 1,400 in January. This is very risky.

Table of Contents

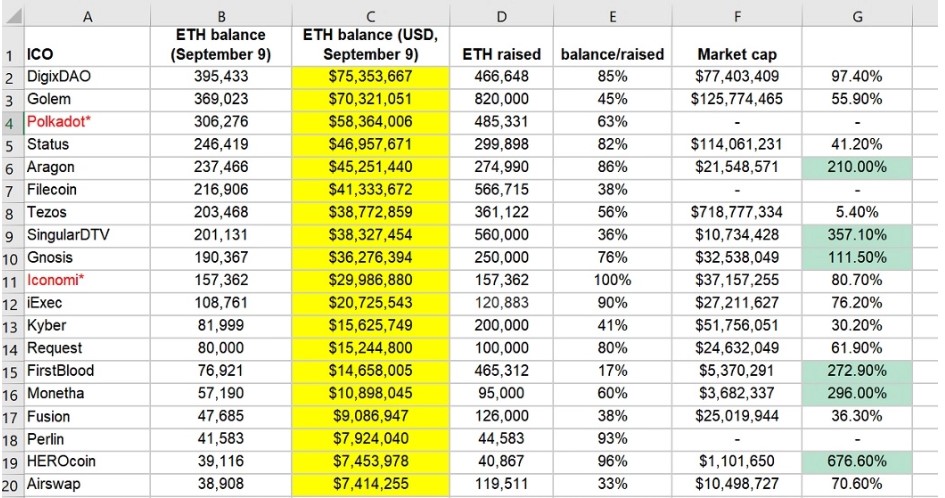

How much in has they total?

Diar mentioned in his tweet that “There is a big misconception that ICO companies have liquidated most of their ETH holdings.” He adds “On average, all of these projects have moved or liquidated 62% of the amount that they initially raised. “In other words, they are still holding 38% of the initially raised amounts.” But in 2017, according to CoinDesk study, collected $ 6.3 billion.

Some Explanations

“This in turn creates ETH selling pressures, which are unlikely to go away any time soon,” said Cermak on Twitter. “The price is affected not only by the ETH mining issuance but also by ICO companies liquidating to cover their expenses.”

“At least 12 ICOs currently have a smaller market caps than the amount that they hold in their ETH treasuries alone – Aragon, SingularDTV, Gnosis, FirstBlood, Monetha, HEROcoin, Bloom, Mysterium, Atonomi, Indorse, Musiconomi and Aventus,” said Cermak. “Seven companies hold more than 200k ETH (not counting Poladot, which has funds stuck in the Parity bug) -DigixDAO, Golem, Status, Aragon, Filecoin, Tezos and SingularDTV.”

On Sept. 8, Ethereum founder Vitalik Buterin told Bloomberg that the days of massive gains in crypto prices are likely over. “The blockchain space is getting to the point where there’s a ceiling in sight,” said Buterin. “If you talk to the average educated person at this point, they probably have heard of blockchain at least once. There isn’t an opportunity for yet another 1,000-times growth in anything in the space anymore.”